When Safe Becomes Risky

You’re counting the days to retirement. Or maybe you’re already retired, but everything seems to be getting more expensive: housing, bills, and let’s not even go into weekly visits to the gas pump and the grocery store. The one thing that doesn’t seem to budge is interest rates.

Inflation doesn’t appear to be slowing down. Between the supply chain logistics aftermath of COVID-19 and the rising international conflicts, there’s no end in sight. Sadly, inflation affects the poor the worst—and then its next victim are retirees. Why retirees? First of all, they are dependent on a fixed income, and then to compound the injury, their safe investments are earning less while the tide of inflation rises, increasing the prices of everything around them. As former baseball player Sam Ewing said, “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.”

Many retirees have excess cash invested at the bank to avoid risk—and for good reason. But there’s another risk you may be taking for playing it too safe. Every investment boils down to three factors: safety, liquidity, and rate of return. No investment has all three, so keeping your funds in a money market savings account or certificate of deposit gives you liquidity, meaning it can be easily withdrawn, and also safety, meaning the money won’t be lost if the market crashes or an investment goes south. But having too much liquidity and safety may prevent your money from keeping pace with the rate of inflation, causing it to lose value.

Effects of Inflation

Let me give you a powerful example of the effect inflation has on stagnant cash: If inflation remains at 7% for 5 years, $300K becomes worth $224k.

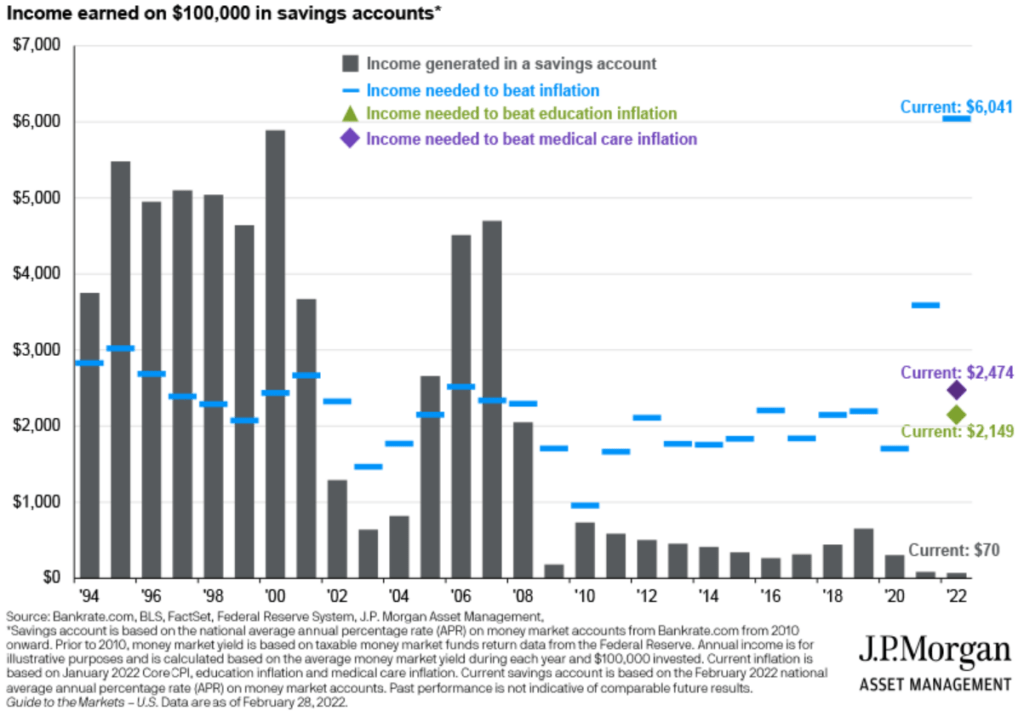

This graph gives us another example. It shows the annual income generated by a $100,000 investment in a typical bank savings account. In blue is the income that would have been needed to beat inflation. As you can see, as the years go by and inflation rises, the savings account is not keeping pace, so the money is losing value.

Cash equivalents are losing money when sitting at the bank, and this has been true since the 2008 financial crisis. The period of savings accounts keeping up with inflation is over.

Call to Action

So what can you do to protect your savings from inflation but also guard it from the potential risk of losing money in an investment?

First, determine whether you have too much liquidity by identifying your ideal emergency fund amount, as you always want to have liquid cash on hand in case of unexpected events. Here are what some financial experts advise to draw a consensus on your emergency fund:

- David Bach: Recommends having at least three months’ worth of expenses set aside in an emergency fund

- Dave Ramsey: Advises saving three to six months of expenses in a fully-funded emergency fund1

- Suze Orman: Encourages aiming for an eight-month emergency fund2

At SWAN Capital, we encourage families to consider, at most, setting aside one year of income, not one year of expenses, for emergencies. If you have renovations or major financial events on the horizon, budget for those as well.

Once you identify an emergency fund goal that’s right for you and your financial situation, then ask yourself: How much extra do I have after my emergency fund is secure?

If you’re sitting on an excess amount of cash and cash equivalents over and above your emergency fund, now is a great time to consider alternatives with higher interest rate opportunities. These alternatives may ensure that your money isn’t losing value by being worth less now than when you carefully saved it. For example, we at SWAN Capital propose investment alternatives such as annuities that get a fixed rate of up to 3.25% (based on a 5-year GILICO annuity in Alabama)

To conclude, make sure your money is working for you, not against you, to maintain the purchasing power of your hard-earned savings so you can make the most of your retirement years.

SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

- Cruze, Rachel. “A Quick Guide to Your Emergency Fund.” Ramsey Solutions, Ramsey Solutions, 24 Sept. 2021, https://www.ramseysolutions.com/saving/quick-guide-to-your-emergency-fund#:~:text=If%20you%20have%20consumer%20debt,a%20fully%20funded%20emergency%20fund.

- Tarpley, Laura Grace. “Suze Orman Says the Usual Savings Advice Isn’t Enough Right Now – You Should Save at Least 8 Months of Expenses.” Business Insider, Business Insider, 1 July 2020, https://www.businessinsider.com/personal-finance/suze-orman-emergency-fund-covid-19-2020-6.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.