WHAT IS CYGNET?

Cygnet is a baby SWAN. It is a Private Equity Real Estate Fund that allows you to invest in real estate without the operational responsibilities that typically come with it. We understand that the allure of real estate is that it’s passive, but as you may have learned the hard way, that’s not always the case. Maybe you’re tired of the obligations of active real estate investments or are brand new to real estate altogether. Cygnet lets your money do the work for you. It is a 506c offering only available to accredited investors ($1M net worth excluding primary residence, or income of at least $200,000 for the last 2 years or $300,000 combined income if married) or qualified clients ($1.1M invested with SWAN Capital or $2.2M+ net worth). You can sit back and enjoy this truly passive investment while we handle the complexities of property management. If you are interested in discussing how real estate can become part of your investment strategy, schedule a call today.

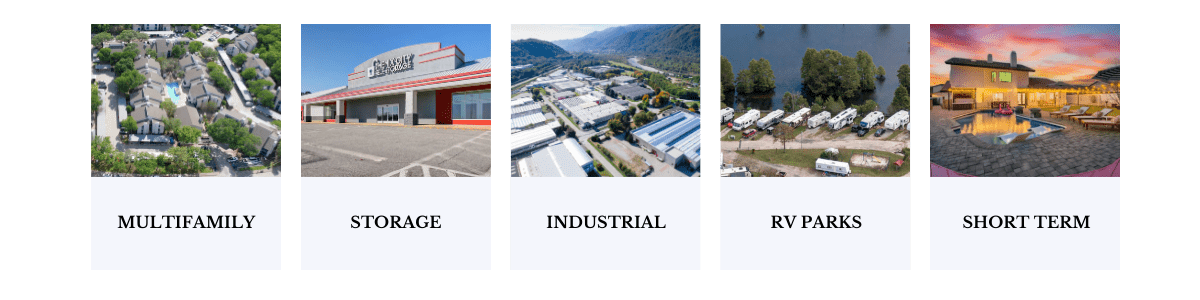

WHY? I started investing in real estate when I had the epiphany that the majority of my business was dependent on the stock market. As a wealth manager, I was preaching diversification but not practicing it. I started buying multifamily properties until I owned over 50 homes and 136 apartments by age 30. But the more houses I accumulated, the more sleepless nights I accrued. Something was constantly breaking, needing replacing, leaking, or literally on fire. Maybe you can relate. Another paradigm changed as I realized the need to diversify into other real estate classes on a greater scale by investing in larger apartment complexes, storage units, and short-term rentals—and that’s when Cygnet was born.

OUR PROCESS AT CYGNET

• DUE DILIGENCE to curate target 15% IRR

• PURCHASE AND VALUE ADS to increase equity & income potential

• MANAGE PROPERTY for long term appreciation

“We believe real estate deserves to be apart of every client’s portfolio in at least some form” – Andrew McNair

“Real Estate adds asymmetrical risk to many traditional assets classes like stocks and bonds our clients already had in their portfolios”

-Andrew McNair

Types of Real Estate Investments

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.