Is the Million Dollar Nest Egg Broken?

We all hear these amounts that we should have saved by the time we retire. We hear we need $1 million dollars, and immediately think – well, I’m already sunk. Others may say you’ll need only $500,000 or $300,000. It can be hard to figure out what we should have saved for retirement. To determine how much nest egg you need, you don’t want to follow a rule of thumb. Using these random numbers is like someone telling you how big your house should be. It should be personal to you and customized to your needs.

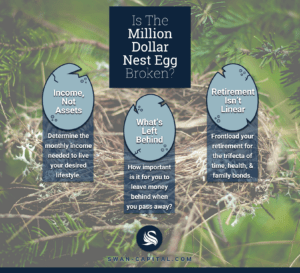

Consider these three factors when determining your nest egg.

- Income, Not Assets – Always remember that you don’t spend assets in retirement. No one accepts assets for groceries. Stores accept only income. I often share with clients that if you offered me $60,000 a year for life or a $1,000,000 lump sum, I am inclined to leave the $1 million behind for the person who expects to find a magical lamp. The key is to first determine what kind of lifestyle you desire in retirement. Take the time write out a budget to help you figure out how much income per month it would take for you follow your passions, achieve your bucket list and sustain the daily leisure activities to which you are accustomed. Next, how many retirement income streams do you already have in place? This includes Social Security, pensions, rental income and any other sources you can depend on for retirement.

- What’s Left Behind – The million dollar number and subsequently the 4% rule are theories that stem from the idea that you don’t want to spend down your principal in retirement. Their popularity is motivated by the fact that no one wants to run out of money before they run out of life. However, if you don’t mind spending down your principal, that opens up another dimension of possibility for planning. That is why we start with the all-important question: “On a scale from 1 to 10, how important is it for you to leave money behind when you and your spouse pass away?” After I ask that loaded question, I sit back with a pen to write down BOTH of their answers. If the couple says things like, “We have paid for their cars, education and helped them get on their way. They have great jobs. They make more than we do. They are self-sufficient. They told me to spend all of my money and don’t worry about them.” These phrases give you permission to begin spending down your principal and their inheritance!

- Retirement Is Not Linear – Retirement is not a simple linear path in which we require the same amount of income every year until we pass. Requiring the same income until you are 98 is just not realistic. Consider front loading your retirement. Many of the best years of your retirement are when you have the trifecta of time, health and family bonds. You finally have the time during retirement to travel and see all the national parks. You and your spouse still have the health to hike them. Lastly, you still have family – like grandkids – who are interested in joining you on a summer trip to see the national parks.

Don’t fall for media headlines that recommend how much money you need to have saved. How much you need is a customized figure for you alone. It is important you and your spouse take the time to assess these three factors to determine your nest egg goal, and to ensure your retirement matches your desires – not your neighbor’s.

SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC.. Neither the firm nor its agents or representatives may give tax advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. Our firm does not provide and no statement contained in the guide shall constitute tax or legal advice. All individuals are encouraged to seek the guidance of a qualified tax professional regarding their personal situation. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.