The U.S. is Saving Billionaires from Bank Failures

Last week was an eventful development in the US banking sector as most investors learned about two regional bank failures: Silicon Valley Bank ($209B in assets) and Signature Bank ($118B in assets) were bailed out by the government.

SWAN Capital doesn’t have any money deposited into Silicon Valley Bank (SVB) or Signature Bank. Portfolios managed by SWAN Capital had no direct exposure to Silicon Valley Bank or Signature Bank. TD Ameritrade/Schwab is FDIC insured up to $250,000 per account. Your account protection is unaffected and your funds in wall accounts were also shielded from these events.

While listening to the news or reading hedge fund manager tweets can be daunting, bank failures seem more alarming than they are. Even though we should be alarmed about how we handle these bank failures, we wanted to share some information on what this means for you and your investments.

What Happened?

Issues that were supposedly fixed a long time ago, mainly bank security of deposits and investment liquidity, were the main concern this week as a bank run on deposits lead two regional banks to bankruptcy within two days of each other. The reason cited was the banks’ investments in long-term treasuries which decreased in value as the Fed increased interest rates and lowered customer demand as borrowing costs increased. The banks were unable to raise the cash to pay for all their clients’ withdrawals. Customers included venture capital firms, private banking customers, and personal credit lines/mortgages to tech entrepreneurs. Needless to say, these investors are very wealthy.

The resolution was communicated by the Federal Reserve, the FDIC, and the US Treasury Department, that these banks would be bailed out through joint extraordinary measures to guarantee all investors capital.

The History of Bank Failures

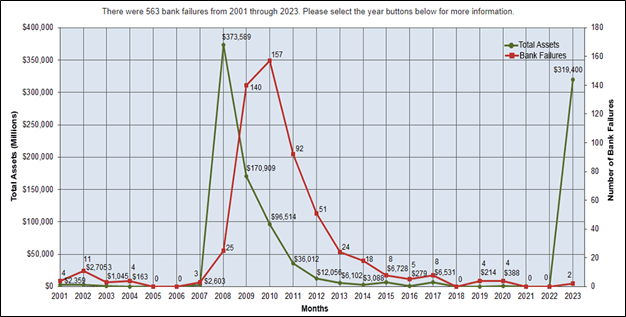

While bank failures happen almost every year, the magnitude of this year’s bankruptcies had a particularly large impact. Bank failures were numerous following 2008 and have been stable since 2015. However, a correlation in this graph is the approximate asset dollar volume (in million) caused by these bankruptcies. Even if the two banks’ failures seem well below the 157 failures in 2010, the assets from SVB and Signature Bank were very elevated.

From 1980 to 1994, the U.S. had 1,617 bank failures, and during the Great Depression of the 1930s, some 9,000 U.S. banks failed. Bank failures are not new but the size of failing banks keeps getting larger.

Should We Expect More Bank Failures?

Yes, there will be more bank failures in the future. When banks are allowed to invest in long-term investments and can’t assume their customer deposits, a bank run can push more banks into bankruptcy. The Federal Reserve is still fighting inflation and interest rates are elevated, which will impact regional banks’ customers and investments.

Last Thoughts and What Should You Do?

These bankruptcies are one of the largest bank failures in U.S. history and have caused panic among other banks and investors. SVB and Signature Bank were bailed out. Is that a surprise? Not really. The government is preventing a domino effect on other banks. Was it justified? That’s another story. If banks get bailed out, it creates an expectation of “too big to fail” and it could create more issues in the future. The nature of these bank failures highlights the pronounced vulnerabilities of today’s financial system.

We want to encourage our clients to make sure their accounts are FDIC insured. As we said earlier, our clients TD Ameritrade accounts are FDIC insured and we have no funds deposited into any failing banks. For your investment portfolio, we also promote dollar cost averaging (the process of investing over multiple weeks), diversification, and lowered exposure to single investments. These strategies help to mitigate your portfolio’s exposure to failing businesses or a volatile economy.

Swan Capital, LLC (“Swan”) is a Registered Investment Adviser (“RIA”). Registration as an investment adviser does not imply a certain level of skill or training, and the content of this communication has not been approved or verified by the United States Securities and Exchange Commission or by any state securities authority. Swan renders individualized responses to persons in a particular state only after complying with the state’s regulatory requirements, or pursuant to an applicable state exemption or exclusion. All investments carry risk, and no investment strategy can guarantee a profit or protect from loss of capital.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.