SLR – The Investing Acronym You Need to Know

Sophistication is not making things complicated—because anyone can do that it. I believe sophistication is perfected in simplification. I want to share one of the brightest lightbulb moments I’ve encountered in finance: Three simple factors that will help you become a better investor. I’m passionate about this topic because I know if these three factors were considered, more investors would make better investments and fewer Ponzi schemes would exist.

There is a caveat to the three factors: You can’t have all three; at best, you will have two of three. Yet learning them will help you ask better questions and allow you to more effectively evaluate an opportunity.

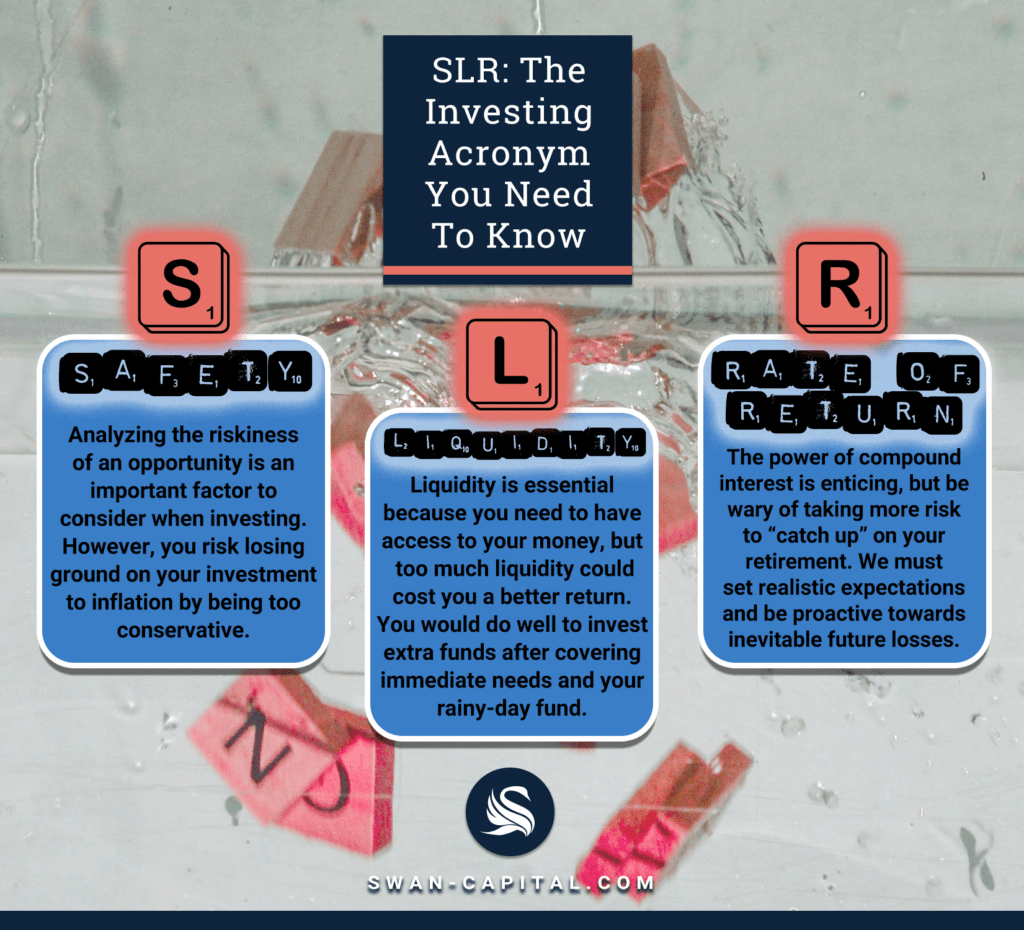

When evaluating any investment, use these three factors to fully assess it:

1. Safety

Many clients have noticed that I’m not as worried about the return on their money as I am in the return of their principal. Investors who prioritize safety understand the value of a dollar. You’ve spent so much time working and budgeting to save all these retirement dollars, so the last thing you want to do is feel like you’re going backwards. Analyzing the riskiness of the investment is an important factor to consider when investing. Even Warren Buffett famously said that the first rule of investing is never lose money—and the second rule is don’t ever lose money. It takes a lot of effort to dig yourself into a hole, but it can take even more work get yourself back where you started. David Bach is right when he said there is no investment that’s worth a good night’s sleep.

On the flip side, safety will cost you if you play it too safe. You take certain risks by being too conservative. In the financial world, it’s called “purchasing power risk,” which is where things become more expensive over time, so if our investments don’t keep up, we will lose ground. Historically, inflation has averaged 3 to 4% per year, so be cautious that your fear of losing doesn’t cause you to lose your savings in the long run.

2. Liquidity

Liquidity is essential because you need to have access to your money. You don’t want to put your dreams on hold, as you’ve waited long enough for your retirement vacation and time with grandchildren. When you’re retired, it’s time to spend your savings—not time to continue to save. Liquidity is an important factor because when your money is liquid, you can enjoy it and quickly move to take advantage of opportunities others cannot.

On the other hand, liquidity can cost you if you have too much of it. Numerous families have more than enough for their immediate needs and their rainy-day fund, so they would do well to invest the extra. Too much liquidity can also cost you a better return. For example, look at the rate of return between a money market and a Certificate of Deposit (CD) within the same bank: The CD should pay more than the money market because one is fully liquid while the other has limitations.

3. Rate of Return

At first glance, it’s enticing to want a great rate of return. We all dream of making it big with a certain stock or a lucrative real estate investment. It is widely accepted that the stock market and real estate markets have outperformed inflation and other asset classes over the long term. The rate of return is synonymous with investing because of the power of compound interest, which is the only way to coast up hill. Once the magic of compounding is really working, your money will eventually be earning more while you sleep than when you are awake. This financial independence can only be achieved by the rate of return. On the other hand, countless investors have been lured by this singing siren of greed. Retirees have made the mistake of taking on more risk to try and “catch up,” but then they take three steps back when the market corrects. At Swan Capital, we’ve found that when discussing rate of return, we refuse to sugarcoat historical returns and prefer putting our worst foot forward first. We start by showing our clients how our portfolios performed during 2001 and 2008. By removing rose-colored glasses, we can accept the reality of the harshness of future losses before they happen. After exploring the worst-case scenarios, we set realistic expectations on the positive side.

Thus, it’s important to remember that financial planning is often like layering in cooking: Every ingredient has its place. For example, salt can add flavor, but too much can make a dish inedible. You might get lucky in the kitchen winging it every once in a while—but when it comes to your retirement, the stakes are too high. When you are contemplating your next investment, my hope is you look at it through these three lenses: liquidity, safety, and rate of return.

Swan Capital, LLC (“SWAN”) is a Registered Investment Adviser (“RIA”). Registration as an investment adviser does not imply a certain level of skill or training, and the content of this communication has not been approved or verified by the United States Securities and Exchange Commission or by any state securities authority. SWAN renders individualized investment advice to persons in a particular state only after complying with the state’s regulatory requirements, or pursuant to an applicable state exemption or exclusion. All investments carry risk, and no investment strategy can guarantee a profit or protect from loss of capital. Past performance is not indicative of future results. Certain information contained herein is based upon hypothetical performance and is only for illustrative purposes only. Hypothetical performance results may have inherent limitations. No representation is being made that any account will, or is likely, to achieve results like those presented. Further, there are oftentimes significant discrepancies with hypothetical performance results achieved by following a particular strategy. A limitation of hypothetical performance results is that they are prepared with the benefit of hindsight. Certain information includes “forward-looking statements” which are statements related to future events or future predictions, including events or predictions relating to our future financial performance, and are generally identifiable by use of the use of forward-looking terminology such as “can”, “often”, “may”, “will”, or the negative thereof or other variations thereon or comparable terminology, or by discussion of strategy that involve risks and uncertainties. Each person reviewing such information should be cautioned that these forward-looking statements and other statements contained herein regarding matters that are not historical facts, are only predictions and estimates regarding future events and circumstances and involve known and unknown risks, uncertainties, and other factors, including the risks that may cause the actual returns and performance to be materially different from those expressed or implied by such forward-looking statements.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.