Are Habits Costing You Your Retirement?

Saving for retirement can be daunting. We have spoken before about saving an entire 20% of your income towards retirement. At first glance that sounds novel but we always seem to have extra month at the end of the money! We all wish we had extra money at the end of the month to invest in our retirement. However, when we look around the house there is no extra cash. What if only a few of the small decisions you make every day are costing you your retirement?

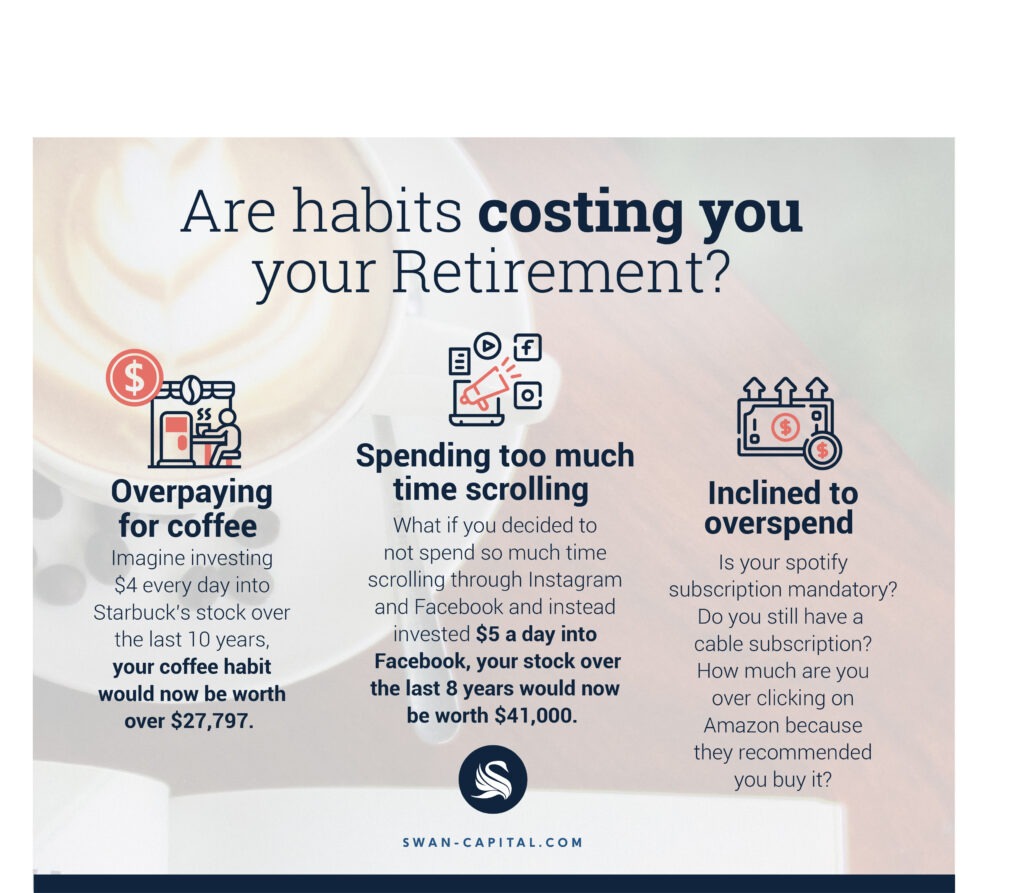

Put another way – what if you invested your “bad” habits instead of enjoying them?

What if instead of making another CEO or founder the next billionaire on the Fortune 400 list, you decide to be the CEO of your finances and invest in those companies that make it so easy to separate us from our money.

- What if you had not spent so much time scrolling through Instagram and Facebook and instead invested $5 a day into Facebook over the last eight years? Your stock would now be worth $41,000.

- What if you decide to drop your habit of overpaying for coffee at Starbucks? In fact, if you had invested $4 every day into Starbuck’s stock over the last 10 years, your coffee habit would now be worth more than $27,797.

There are many examples of ways we are inclined to overspend. Is your Spotify subscription mandatory? Do you still have a cable subscription? How much are you over clicking on Amazon because they recommended you buy it? If you were to review your Apple account, see how many extras add up that are costing you your retirement. We could go on and on, but here is my challenge for you. I encourage you to download a copy of your cash flow sheet and treat it like a puzzle. Make it a game to find all the ways (besides the necessities) you are dripping nickels through your hands every day. If you have a spouse, make it a competition to see who can find all the “extras” you two are unknowingly overpaying for. Maybe you could buy all the fixings and start making better coffee than your favorite barista makes for you.

Now, I am not saying that buying a coffee or wasting a few minutes on social media is going to ruin your finances. It’s important to have balance. No one should be labeled greedy, miserly or labeled a Scrooge. However, for many people the opposite may be true: We are living out of balance when we live as if retirement will never happen. If you think investing is risky, try to imagine how risky poverty could be.

We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. Investment advisory services offered only by duly registered individuals through Swan Capital.Investing involves risk, including the potential loss of principal. This inform ation is not a solicitation to buy or sell any product or security. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. 661702 – 7/20

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.