Exponential Saving

When you hear that you need to save 20% of your income, it can feel intimidating. To go from saving 0% of your income to 20% could feel similar to trying to stop a moving train. I believe we must draw a line in the sand somewhere, and 20% is the line where we should prioritize saving for our future. If not, as consumers we become investors in the future of the US via taxes and investing, and in the future of people like Jeff Bezos, founder of Amazon.

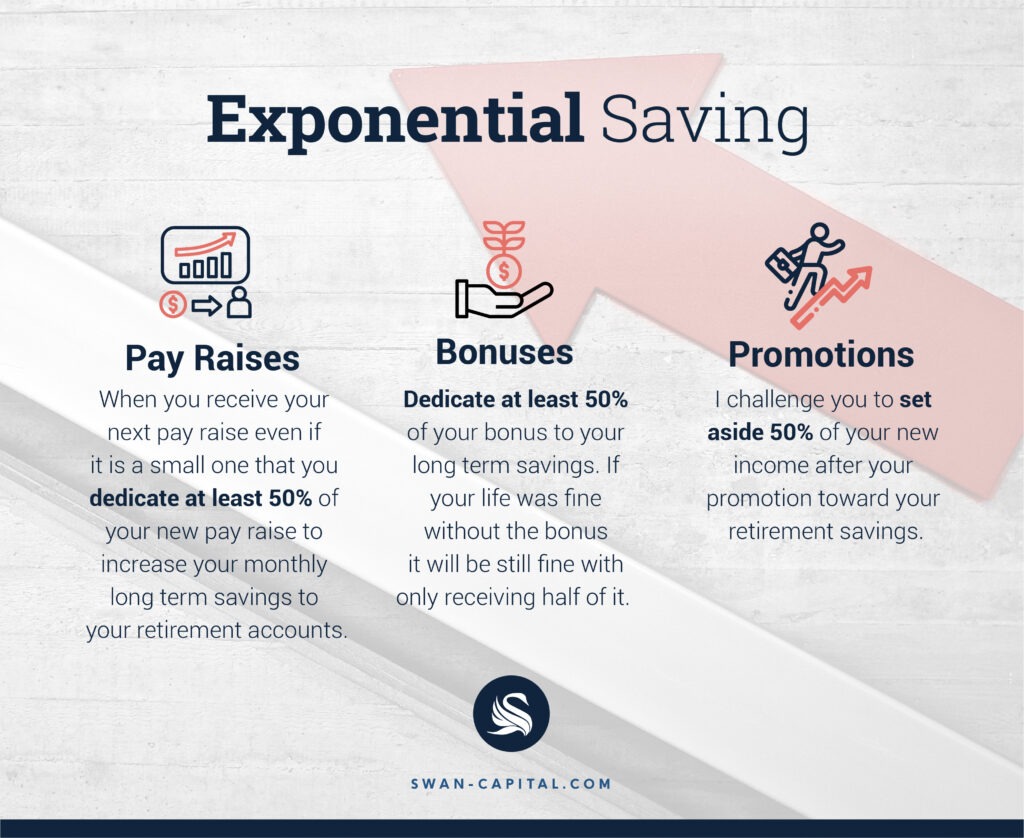

I want to encourage you with a way to methodically and systemically increase your savings. We call this technique Exponential Saving, and we believe it is the key to pushing the needle in your savings rate.

1) Raises

Can you remember, after you finished college, how much you earned when you started your career? Do you remember how much you were making when you got married? Were you happy back then, and are you happy now? If you compare what you earn now to what you did back then, you probably never dreamed of making what you do now. However, I joke when I give advice to young people: When most people get raises they try very hard to spend it to prove to everyone around them that they received a pay raise. I challenge you to turn over a new leaf. When you receive your next pay raise, even if it is a small one, dedicate at least 50% of your new pay raise toward increasing your monthly long-term savings to your retirement accounts.

2.) Bonuses

When a company is doing well, many businesses reward their employees with bonuses. If I were to take a poll of the top five things people spent their bonuses on, I would get a lot of blank stares. The reason is because it is human nature that, when we receive a large unexpected financial surprise, we are very good at getting rid of it and not having much to show for it. I want to challenge you to not let your future bonuses evaporate, ever again. Instead, dedicate at least 50% of your bonus to your long-term savings. If your life was fine without the bonus, it will be still fine with only receiving half of it.

3) Promotions

You stay late, you work harder than many of your peers, you don’t abuse the company’s time/resources and you are constantly sharpening your skills along the way. It is no surprise to your family when you get a promotion because they have been saying that you deserved one for years. Sadly, upon receiving a new name badge and having more people reporting to you, we are inclined to enjoy all the fruits of our labor. I challenge you to set aside 50% of your new income after your promotion toward your retirement savings. To go from saving 0% of your income to 20% overnight can be daunting. Implementing these small changes can serve as a catalyst to provide the momentum you need.

Investment advisory services offered only by duly registered individuals through Swan Capital.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.