Financial Milestones – Ages 50 – 80

Retirement can be confusing! How do you know if you’re on track for your age? How can you give your children and grandchildren a head start on financial responsibility so they’re prepared for retirement down the road? One of the best ways to keep yourself and your children on track with key financial decisions is to match those decisions up with age-based milestones.

This is our second article in a series about lifetime financial milestones, covering ages 50 – 80. In case you missed it, don’t forget to check out the first article that covers childhood into adulthood!

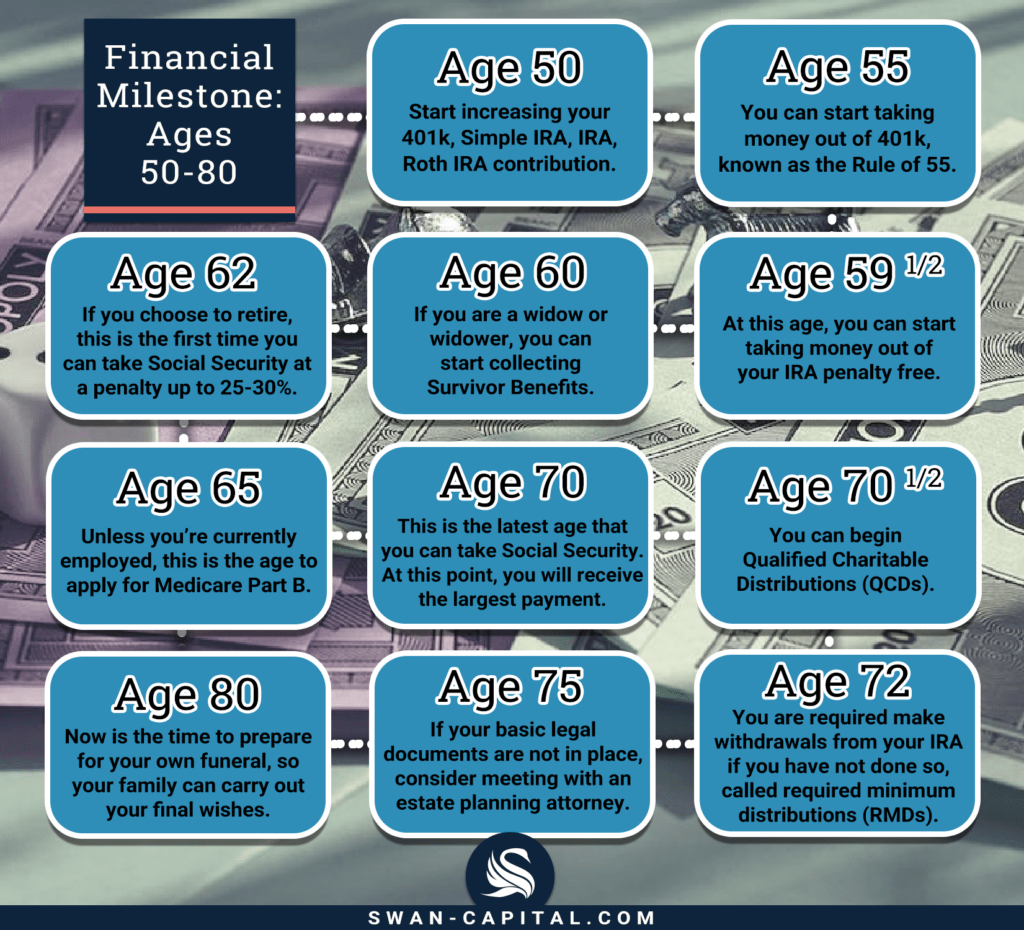

Age 50: You can start increasing your 401K, Simple IRA, IRA, or Roth IRA contribution at this age. It would be a great place to give them the amounts and the increased amounts on each of these accounts.

Age 55: This is the age you can start taking money out of a 401k, known as the Rule of 55. The Rule of 55 terms state that you can withdraw funds from your current job’s 401k or 403b plan without a 10% tax penalty—but only if you leave the job in or after the year you turn 55.[1] This is a great option for those who want to retire early and need more cash flow. Don’t make the mistake of rolling this money into another retirement plan or an IRA at this age, as the Rule of 55 does not apply to these accounts, and you would have to pay a penalty on withdraws on these accounts until age 59 ½.

Age 59 ½: At this age, you can start taking money out of your IRA penalty free.

Age 60: If you are a widow or widower, you can start collecting Survivors Benefits from your previous spouse via Social Security. In most cases, a widow or widower qualifies for survivor benefits if he or she is at least 60 and had been married to the deceased for at least nine months at the time of death.[2] Keep in mind that you will receive Survivors Benefits until you are eligible to start receiving your own monthly Social Security or retirement benefit, at which point you will not receive both the survivor benefit and your own retirement benefit. Instead, Social Security will pay you the higher of the two amounts. The requirements can vary depending on the situation, especially if the surviving spouse has a disability or remarried, so speak with a Social Security representative to determine the benefits you are eligible for.

Age 62: If you choose to retire, this is the first time you can take Social Security. However, you’re getting a penalty of up to 25-30% for taking it prior to your full retirement age, which for most people is now 67. If you take Social Security more than 36 months before retirement age, the benefit is reduced 5/12 of one percent per month. At 36 months, the benefit is reduced 5/9 of one percent per month.[3]

Age 65: Unless you’re currently employed, this is the age to apply for Medicare Part B. There is a window of time where you must apply for Medicare prior to your retirement or after your retirement without facing a penalty.

Age 70: This is the latest age that you can take Social Security. At this point, you are maxing out your Social Security and will receive the largest payment if you take it at age 70. It can be up to 25-30% more than taking out at age 62.

Age 70 ½: You can begin Qualified Charitable Distributions (QCDs). A qualified charitable distribution is an otherwise taxable distribution that is paid directly from the IRA to a qualified charity. A QCD satisfies your Required Minimum Distribution (RMD) on qualified accounts such as your IRA, which are required at age 72, but allows you to give to the charity of your choice tax free. The great thing is that you can apply all or part of your RMDs to charity as a QCD.

Age 72: At age 72, the IRA requires you to make withdrawals from your IRA if you have not done so, called required minimum distributions (RMDs). Everyone’s RMD is different, based on your account value and age. To calculate your RMD, divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on December 31st each year.[4] However, I advise retirees not to wait until they’re RMD age to start taking money out of their retirement plans because once you reach RMD age, you’re limited in options. For example, the RMD cannot be put into a Roth IRA and must be spent or reinvested in a possible another investment where you could pay taxes again on the gains.

Age 75: At this point, your basic legal documents should already be in place. If they are not, please consider meeting with an estate planning attorney to discuss a last will, living will, and power of attorney for medical and financial. Plus, you can use this opportunity to also discuss optional documents with them such as life estate and/or trusts for your real estate.

Age 80: Now is the time to prepare for your own funeral so your family can carry out your final wishes. As part of your preparation, consider pre-burial plots if you haven’t already. If you’ve decided to have a Durable Power of Attorney for Health Care (DPOAHC), you can assign the family member or person of your choice in this document as an agent to make funeral arrangements on your behalf. Now is also the time to schedule an appointment to have your legal documents reviewed a second time by a professional.

Alan Lakein, an expert on time management, advises, “Planning is bringing the future into the present so that you can do something about it now.” Being aware of key financial milestones for your age—or upcoming ages—is one way to set you and your family up for financial success.

[1] https://www.bankrate.com/retirement/rule-of-55/#:~:text=The%20rule%20of%2055%20is,they’ve%20reached%20age%2055.

[2] https://www.ssa.gov/benefits/survivors/ifyou.html#:~:text=Survivors%20Benefit%20Amount,-We%20base%20your&text=Widow%20or%20widower%2C%20full%20retirement,50%20through%2059%20%E2%80%94%2071%C2%BD%25.

[3] https://www.ssa.gov/oact/quickcalc/early_late.html

[4] https://www.bankrate.com/retirement/ira-rmd-table/

SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.