Reverse Dollar Cost Averaging

The reason is easy: You become accustomed to forty years of paychecks and investing in your 401(k) for the long term, and then have to flip the script upside down and convert your retirements savings into income for the next thirty years. All the while, you try to make sure it lasts your whole lifetime, which you don’t know how long that will be.

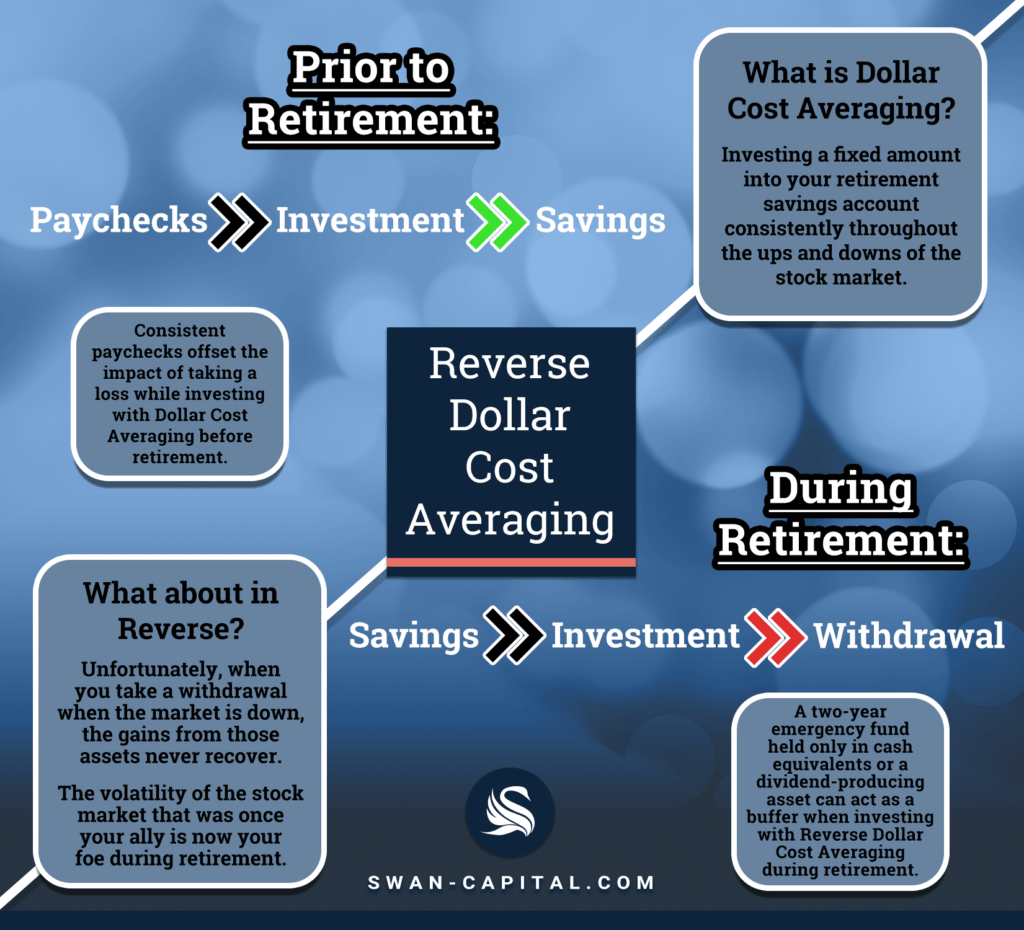

Another reason is, when you are saving for your retirement you have the strategy of dollar cost averaging on your side. This is a tried, true and tested theory of investing that works while you are saving for retirement. Dollar cost averaging is simply the process of investing for the long haul by investing a fixed amount into your retirement savings account consistently throughout the ups and downs of the stock market. It has been proven over and over again that trying to time the market is a fool’s game. By dollar cost averaging, you will buy stocks at all-time highs, but also many times when prices have dropped and others are selling.

Yet when you retire, everything you know comes to a screeching halt. Imagine playing a game of tennis then the official decides to exchange the rules with golf. The rules, positions, lingo, scoreboard, equipment and the field all have to change. This is much like shifting from accumulating for retirement to finally spending your retirement assets.

Now, how does reverse dollar cost averaging work? When you retire, you want the same predictability of your 40 years receiving a paycheck at the same times each month. However, I know it sounds basic, but when the market is volatile, you cannot time your withdrawals with the ups of the stock market. Unfortunately, when you take a withdrawal when the market is down, the gains from those assets never recover. Therefore, the volatility of the stock market that was once your ally is now your foe in retirement.

Sadly, some families who are not prepared for reverse dollar cost averaging may have to delay their retirement, suppress spending during their long-awaited retirement or, worse yet, sell their stocks for a loss. All of these are terribly short straws to pull for your family during your retirement.

How can you ensure your retirement is protected from reverse dollar cost averaging? It is important to have a “retirement buffer”. This retirement buffer may be a two-year emergency fund that is held only in cash equivalents or a dividend-producing asset like an annuity that provides issuer-guaranteed income for your family. By having the guaranteed retirement income separated from the stock market, it allows you to make more long-term growth focused decisions when investing. The average bear market lasts 14 months, while the longest has lasted as much as 61 months. Therefore the first stash of stockpiled emergency funds will suffice for the average bear market, but in longer droughts you are rolling the dice.

Many investors turn their nose up at guaranteed income sources like annuities because the returns are low. Under a microscope and separated from all other constants, this may be correct. However, sound financial planning is comprised of building a holistic financial plan that increases the total potential return.

Remember, gravity can either work for you or against you when moving objects. Dollar cost averaging can work for you while saving for retirement or against you during retirement.

https://apnews.com/84ee301c404539d8731da34128330752

Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM) and/or Swan Capital. AEWM and Swan Capital are not affiliated companies.

We are an independent firm helping individuals create retirement strategies using a variety of insurance and investment products to custom suit their needs and objectives. This material is intended to provide general information to help you understand basic financial planning strategies and should not be construed as financial advice. All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

The information contained in this material is believed to be reliable, but accuracy and completeness cannot be guaranteed; it is not intended to be used as the sole basis for financial decisions. If you are unable to access any of the news articles and sources through the links provided in this text, please contact us to request a copy of the desired reference.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.