What to ask a Financial Advisor

Finding the right advisor can be more intense than a trip to the dentist. If you are currently with a financial advisor or searching for a new one, it can seem overwhelming. You have to gather everything confidential about your family and become financially exposed to a stranger. You probably have countless questions swirling in your mind ranging from: Did I save enough? Will I run out of money? Have I invested too risky or too conservatively? Will I have enough to pay for long-term care costs? What’s a 403(b) anyway? All the while hoping the advisor doesn’t ask you a question that could make you feel ill-prepared in front of your spouse.

Hiring a financial advisor doesn’t have to be fear-inducing. Remember, you are doing the hiring and have full reign to ask all the questions on your mind. Interviewing a financial advisor should be an informational exploration; the goal is to build a trusted relationship with a financial “coach” that may last the rest of your life. I encourage you to be bold and ask hard questions – we are talking about your nest egg, after all.

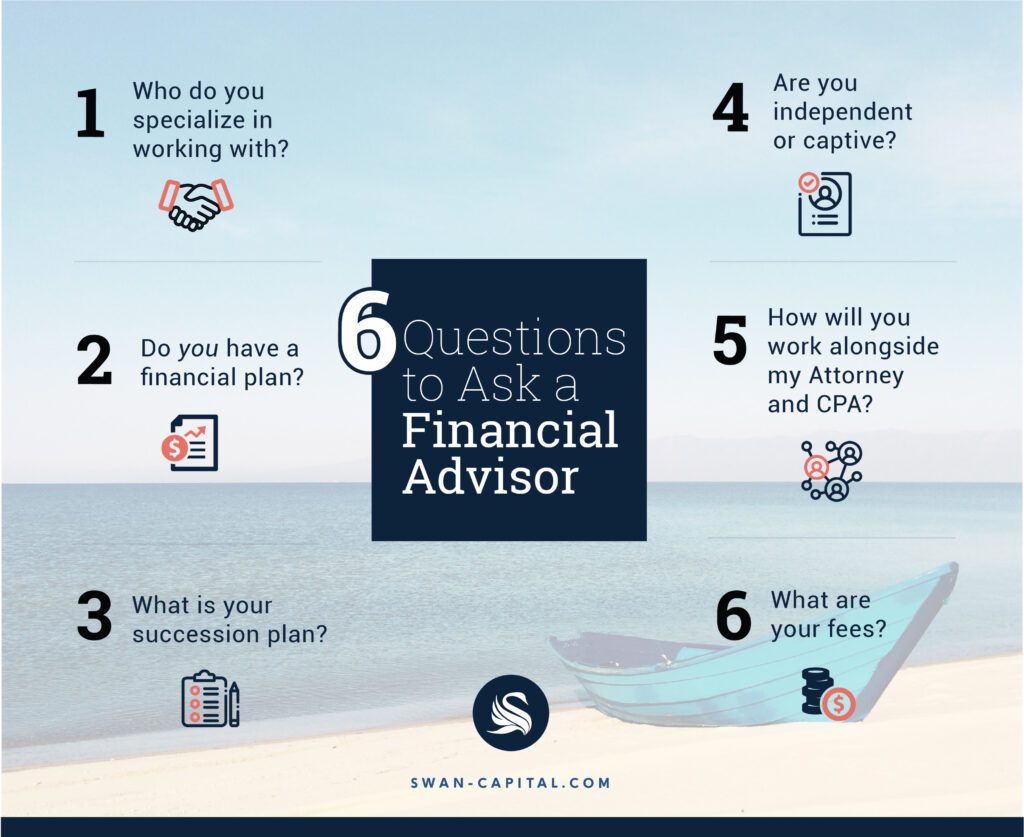

Here are 6 questions that can be very revealing:

1. Who do you specialize in working with? – If my dentist, with a sharp tool in hand, says “Hmm, I have never seen this before”, my eyes may enlarge a bit. Does the financial advisor you are interviewing work with any and every type of client? If so, that may not be very comforting. Do they work with families with a wide range of net worth? If so, will they be able to relate to your personal financial goals? Depending on your profession, you may want someone that is familiar with the planning intricacies of your situation.

2. Do you have a financial plan? Warren Buffet once said, “Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway”. If I am sitting down for dinner and notice the chef, via the pass-through, is disgusted at what he is tasting in the pot, I will not ask my server to give me what he is having. Yet, in the financial industry, families take financial advice from professionals who may not even be investing in the same vehicles they recommend. If they recommend products they don’t personally own, I would want to know why. Ask if the financial planner has his own detailed plan. Since each individual has their own unique financial goals, risk tolerance, and needs, a financial advisor’s plan would obviously be customized to him or her. Remember that when you take advice from someone you should be prepared to trade places with them.

3. What is your succession plan? 37 percent of my colleagues are expected to retire over the next decade.1 This statistic should encourage clients to make sure they are not going to be immediately passed off to an advisor that might not be as experienced. My clients tell me they pick younger doctors for a reason. This is because they understand younger physicians may be more up to date with current trends or cutting edge technologies and, by probability, will most likely outlive them.

4. Are you independent or captive? Would you expect a Ford dealership to recommend a Chevy? Of course not, which is why it is wise to work with an independent advisor. Independent advisors will have access to various financial products and companies, while a “captive advisor” can recommend only the products offered by his firm. When buying a car, not everyone should have the same vehicle…nor should everyone have the same kind of financial vehicle.

5. How will you work alongside my attorney and CPA? Financial planning, tax planning and estate planning shouldn’t be performed in vacuums. Successful investors know that synergy among all professionals is essential when creating a holistic financial strategy. You should expect to see a detailed process outlining the coordination between with these professionals. If this process is missing, you may end up being the messenger tasked with coordinating all of their efforts.

6. What are your fees? Do not settle for the stock response: “We charge 1 percent”. Are there additional trading costs or other fees you should be aware of? The truth should be transparent. Most people do not mind paying for a service in which they receive equal or greater value for the cost.

Interviewing a financial advisor can be one of the most important meetings you will conduct. If you choose an unsuitable advisor, you could stand to lose more than just the possibility of good returns. You could lose something far more important than money: Your time. Working with an advisor who does not align with your goals could jeopardize months or years of saving and potentially delay your retirement. Working with a financial advisor who is focused not only on growing your assets, but also preserving and distributing them in an efficient manner, can play an integral part in staying on track toward the retirement you desire. As an investment adviser representative and insurance professional, I welcome these questions and so should your future financial advisor.

1 https://www.fa-mag.com/news/the-financial-advisory-space-stands-to-lose-one-third-of-advisors-toretirement-in-the-next-decade-52579.html Investment advisory services offered only by duly registered individuals through Swan Capital. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. This content is provided for informational purposes only and is not intended to serve as the basis for financial decisions. Swan Capital has a strategic partnership with tax professionals and attorneys who can provide tax and/or legal advice. 00584538

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.