The Real Estate Professional Status:

A Guide for Retirees with Rental Properties

Whether you own a portfolio of rental homes or are just curious about the benefits of real estate investment, understanding the Real Estate Professional Status (REPS) could be a game-changer for you. This status offers significant advantages for real estate investors, especially when it comes to saving on taxes.

What is REPS?

Essentially, the Real Estate Professional Status is a special designation from the IRS that allows qualified individuals to treat their rental activities as non-passive, thus providing significant tax benefits.

To qualify, you must spend more than 750 hours per year actively involved in real estate activities such as renting, leasing, managing, and maintaining properties. This breaks down to about 14-15 hours a week—definitely manageable for many retirees looking to actively engage with their investments.

It is important that this time spent on real estate exceeds half of your total working hours, so if you have other jobs, ensure your real estate focus takes up the majority.

How can it help lower your taxes?

Normally, rental losses can only offset passive income, but if you qualify as a real estate professional, these losses can offset active income, leading to significant tax savings. This can greatly reduce your taxable income by allowing you to deduct rental losses against wages, business income, or other taxable events such as IRA distributions or RMDs. The ability to deduct all rental losses against any other income can create sizeable tax advantages, especially if you have significant depreciation deductions.

One effective strategy for REPS to save you money is depreciation, which allows property owners to recover the cost of income-producing property through annual tax deductions. With cost segregation analysis, you can identify components of a property that can be depreciated over shorter timeframes, leading to increased write-offs in the early years of ownership.

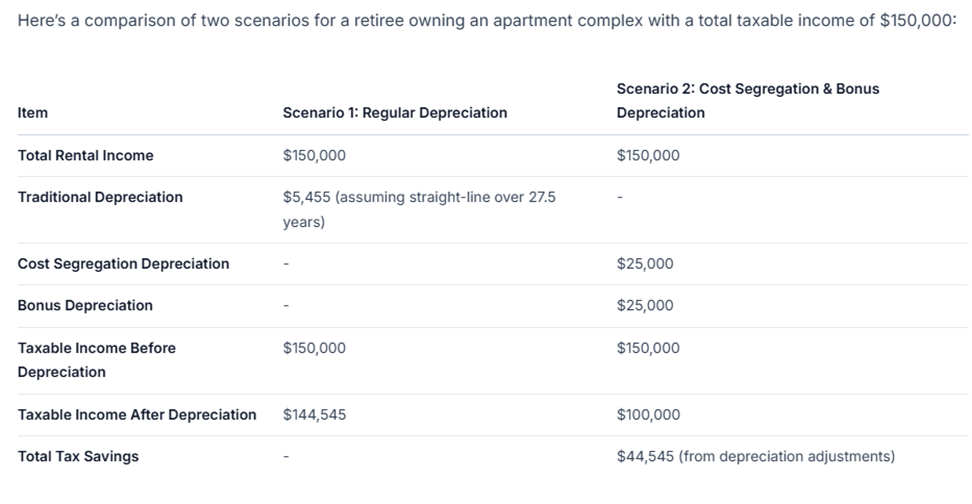

For example, if you own a property with a taxable income of $150,000, traditional depreciation might span over 27.5 years. However, a cost segregation analysis could allow you to depreciate certain components much faster, potentially reducing your taxable income significantly. One tool at your disposal is bonus depreciation, which lets you deduct a large percentage of the purchase price of eligible business assets in the year they’re placed in service. This can provide immediate and substantial tax savings.

How can you start?

First, you need to dedicate time to your investment properties. Spend at least 750 hours annually on real estate duties and talk to a professional to see if you are eligible.

Then, you need to document your activities. Documentation is crucial in proving your eligibility. Keep detailed logs of time spent on various real estate activities, such as property inspections, tenant communications, repairs, and administrative tasks.

Finally, talk to your financial advisor and find a cost segregation company. Cost segregation is the tax planning strategy that identifies specific components of a property and reclassifies them to allow for accelerated depreciation that we talked about earlier. Our SWAN Capital advisors can point you in the right direction for your next steps.

Final Thoughts

At SWAN Capital, we believe in owning uncorrelated asset classes. Yes, it is important to have fixed investments, stocks, and ETFs in the public market. However, we should not neglect owning real assets like real estate. This is why we have our Cygnet Fund, a Private Equity Real Estate Fund that enables you to invest passively. The beauty of these passive investments is that if they are invested in concert with your actively managed real estate holdings, you can accumulate extensive depreciation that provide many tax advantages.

By combining passive investments with active management, you can optimize your tax position and enhance your overall financial strategy. Passive real estate investments through funds like the Cygnet Fund can provide diversification, potential for appreciation, and additional tax benefits, creating a robust and balanced investment portfolio.

Relevant IRS Codes and Resources: For more detailed information and guidance, refer to the following IRS codes and resources: Section 469(c)(7): Treatment of rental real estate activities for taxpayers materially participating in real property trades or businesses. Read more on IRS.gov Section 168(k): Rules related to bonus depreciation and its applicability. Read more on IRS.gov Section 167: General rules for depreciation. Read more on IRS.gov

Covering our Tail Feathers Welcome to Swan Capital, LLC (“SWAN”), your friendly neighborhood Registered Investment Adviser (“RIA”). Now, while we may have a fancy title, remember that our registration doesn’t guarantee we’re flying high above the rest. This communication hasn’t been blessed or verified by the United States Securities and Exchange Commission (SEC) or any state securities authority. At SWAN, we believe in giving you personalized investment advice as unique as a swan’s graceful glide. We work with clients in their own states, making sure to play by all the regulatory rules or find the right exceptions. But here’s the scoop: all investments come with risks—like a wild swim in the pond—so no investment strategy can promise profits or protect you from the occasional splashdown. Just remember, past performance is like a cozy old story; it might be nice to reminisce about, but it doesn’t promise what’s coming next. This information is intended for educational purposes only. Always consult a CPA to validate and verify your tax planning strategies and ensure compliance with current tax laws. As a wealth management firm, we aim to provide valuable insights, but we are not tax professionals.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.