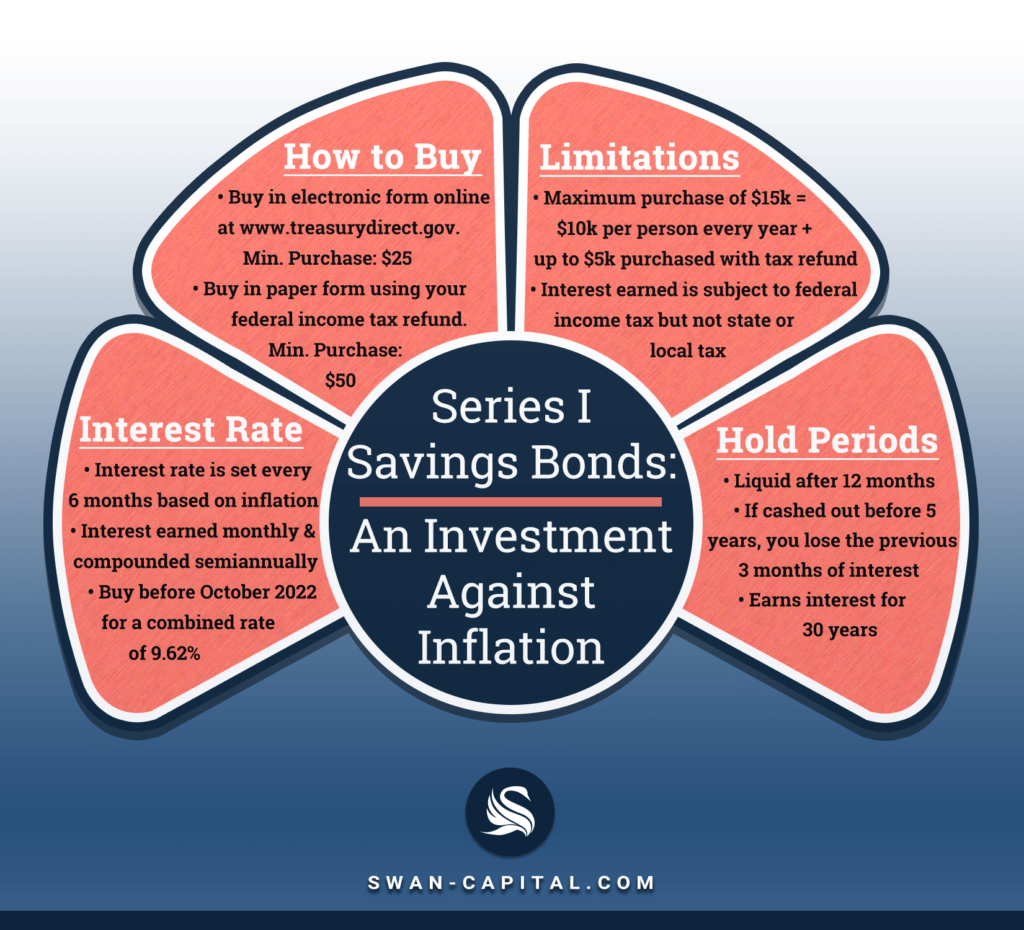

Series I Savings Bonds: An Investment Against Inflation

In a high-inflation environment and with the market going down with no end in sight, not many investment options provide the return necessary to keep up with inflation, except for I bonds.

Yes, we recommend them, because they are safe, provide a good return when inflation is elevated, and are liquid after 1 year.

Many people have heard about them on TV or on the radio, but here is all you need to know about I bonds.

Interest Rate:

The interest rate is set every six months based on inflation levels. The interest is earned monthly and compounded semiannually.

If you buy an I bond before October 2022, you will get a combined rate of 9.62%.

How to buy:

You just establish an account at https://www.treasurydirect.gov/

Two options:

• Buy them in electronic form in their online program TreasuryDirect

• Buy them in paper form using your federal income tax refund

• Min. Purchase Electronic: $25

• Min. Purchase Paper: $50

Limitations:

The maximum purchase is $10,000 per person every year. However, you can also use up to $5,000 from your federal tax refund to purchase I bonds, so you could potentially purchase $15,000 in one year.

The interest that your savings bond earn is subject to federal income tax but not state or local tax.

Hold periods for the bonds:

The money must remain in the bond for at least 12 months before taken out. If you cash them out before five years, you lose the previous three months of interest. For example, if you cash a I bond after 18 months, you get the first 15 months of interest. I bonds earn interest for 30 years.

SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.