RMDs: Be prepared

If you are hearing that Required Minimum Distributions (RMDs) are not a big deal, I want to share with you some hard truths about RMDs .

RMDs are distributions from qualified accounts imposed by the federal government in order to force investors to pay taxes on previously untaxed assets. The purpose of RMDs is not for your benefit, but rather a quest for tax revenues. The IRS defines the amount RMDs that must be withdrawn each year and provides these guidelines for investors.

How much is my RMD? – RMDs are calculated by using a Uniform Lifetime Table that typically starts your distribution at roughly 3%, and increases over time. This percentage will become larger as you get older, which forces you to reduce your qualified accounts. The easiest way to calculate your RMD is to inventory all of your IRA balances on December 31st of last year, add them together and utilize a trustworthy calculator on the internet. Many institutions will start sending you an annual notice of your RMD amount for the accounts they hold, starting at age 72.

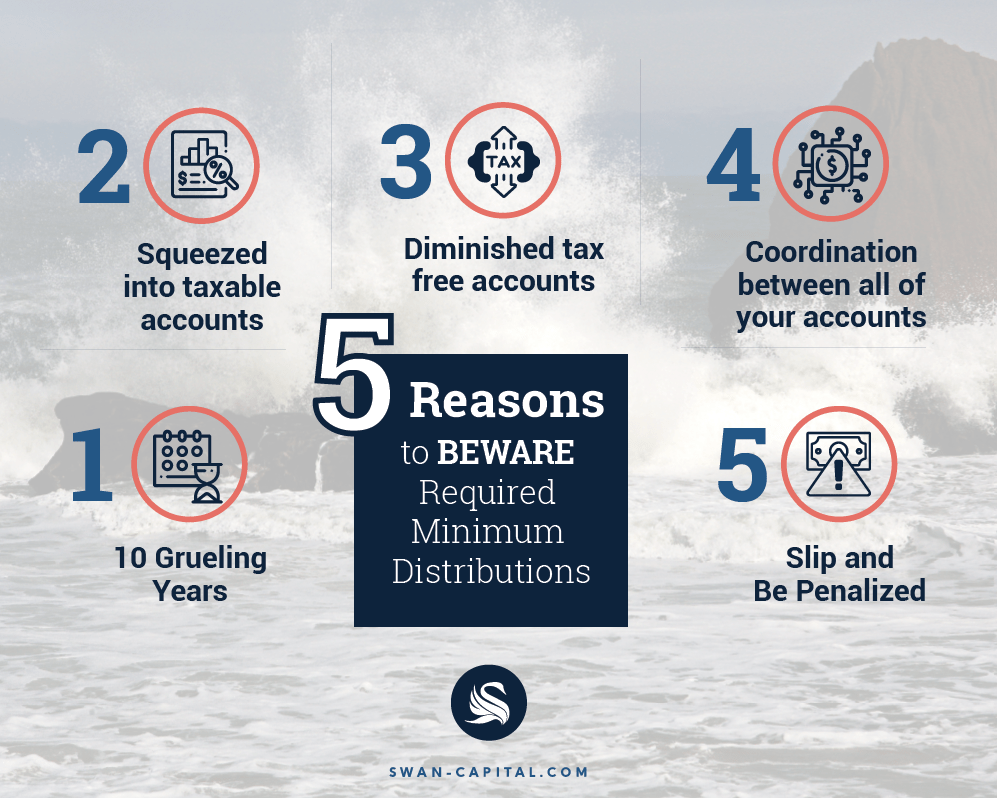

Why you should beware of RMDs

10 Short Years for Nonspouse Beneficiaries – If you do not finish unwinding your retirement savings via RMDs before you pass away, the tax bill is not swept under the rug. Instead, you will have to hand over your IRA to future beneficiaries, not as a gift certificate, but as a coupon. Your family will receive those funds with the taxes still owed upon distribution. For nonspouse beneficiaries, the account must be depleted within a 10-year period. The sad reality is that many beneficiaries are still working, so this increase in income can have devastating tax implications. It could mean leaving your beneficiaries with less and passing on more of a tax burden.

Squeezed into taxable accounts – The other little known fact about RMDs is that those distributions cannot be converted to a Roth IRA. Instead, many retirees place RMD assets in a taxable account, like a CD, money market or savings account. These accounts are taxable which means that any further interest you earn on those assets will also be taxed. This can be very frustrating for astute investors.

Diminished tax-free accounts – If you want, you can place excess RMDs in a Roth IRA. You’ll still have to pay taxes on the full RMD amount, and the distribution will increase your income even further, which can push you into higher tax brackets. In this case, you may be paying more taxes than you initially wanted to on your Roth conversion.

Coordination between all of your accounts – I have known new clients to have 5 to 10 IRAs between two spouses. Imagine the heavy lifting of coordinating all of those RMDs that need to be taken before the end of the year. While you must meet the RMD requirement for each account, you are allowed to take the combined amount from just one of your IRAs. Many people take their RMD at very end of the year, but this requires that you review the prior year’s year-end account balance. When you are retired the last thing you want to do is hunt down statements, account values on certain dates and run calculations for the correct RMD.

Slip and Be Penalized – I have witnessed many families unfortunately make a simple mistake, such as not calculating their RMD correctly. Or, they may have taken an RMD from one IRA but forgot about another. These mistakes can cost families a 50% penalty on any amount above what they were required to take that year. One little mistake can have big consequences.

RMDs are often treated nonchalantly in retirement planning. However, retirement is an ideal time – while taxes are low – to unwind your IRA before your reach the dreaded RMD age. If you are already over the age of 72, be sure to work with a CPA and financial advisor to help guide you through RMD withdrawals and to discuss the possibility of Roth conversions.

Investment advisory services offered only by duly registered individuals through Swan Capital. Swan Capital are not affiliated companies. A Roth Conversion is a taxable event and may have several tax-related consequences. Our firm does not provide tax advice. We are an independent firm helping individuals create retirement strategies using a variety of insurance and investment products to custom suit their needs and objectives. This material is intended to provide general information to help you understand basic financial planning strategies and should not be construed as financial advice. All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The information contained in this material is believed to be reliable, but accuracy and completeness cannot be guaranteed; it is not intended to be used as the sole basis for financial decisions. If you are unable to access any of the news articles and sources through the links provided in this text, please contact us to request a copy of the desired reference.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.