Refinancing within Retirement

Isn’t it ironic that ever since the day you bought your first house, you looked forward to having it paid for? Having your home paid off can be part of most families’ American Dream. I have met with countless retirees who believed paying off their mortgage was essential to their retirement—and for good reason. Many of you remember when interest rates were higher—as much as double digits—and you never want to be caught in that trap again. Or maybe you watched a family member struggle financially because of the burden of a large mortgage payment.

As a retiree, does it make sense to refinance to pay your house off early? What should you consider before you do?

When Is the Best Time?

Determining the best time to refinance begins with looking at your current mortgage rate. If current market rates and your current mortgage rate are 2% or more apart, then refinancing your home is certainly worth investigating. If the difference is less than 2%, do your due diligence because it may take too much time to recover your refinancing costs. Another point to keep in mind is whether your home is your permanent home or not. If not, you need to consider in your decision how many years you plan to stay in it.

What Dial Should I Twist?

Once you determine you’re a good candidate for a refinance, you have to decide which dial to turn: time or payment. I encourage my clients to start with time, especially if you can shave 5 to 10 years off your payment schedule in order to align the maturity with your retirement date. Also, consider that if you or your spouse were to pass away, one of you will lose a social security check and other potential income sources, so paying your house off early through refinancing may prove financially beneficial.

The second dial is payment. If you are single or have very few beneficiaries, having a paid off home may not be a priority. In that case, you may want to refinance to reduce your house payment so you have a place to stay and so your monthly payment will not take up a large percentage of your retirement income. Now, inflation works alongside you when paying off your mortgage. Keep in mind that as things become more expensive, your mortgage payment is a fixed payment for 10, 15 or 30 years. This payment becomes less of your overall income over time if you have a cost-of-living adjustment.

Uses of Your Refinance

I have witnessed many families utilize a refinance in many different ways. One is paying off consumer debt. If you use a cash out refinance to pay down high interest consumer debt, it is imperative that you not get back into debt. The key is to refinance, reduce your debt load and lower your interest rate. Another way to use a refinance is to use the funds to fix up your house and/or buy a rental property if that makes financial sense.

How Can I Refinance or Get a Mortgage on Fixed Income?

I have had many clients say, “I don’t think I could apply for a mortgage because I’m not working anymore. I don’t have any paychecks coming in anymore.” That’s a misconception! Don’t be afraid of refinancing if you have no earned income. Social security and pensions do count as income, and the lending professional can use your gross amount of social security and pensions. Don’t forget that your Required Minimum Distributions (RMD) also count as income even though it is paid out once per year. In addition, your dividend income will count from your investments. Lending professionals often need a letter from your financial professional (like me) to help substantiate dividend income and net worth statements. If your dividend income is deferred, lending professionals can use an asset-based formula to calculate it using your assets divided by the length of the loan.

Setting Your Mortgage Up for Success from the Beginning

Make sure you speak to your lender about recasting. Often, this topic must be discussedupfront during the application process. Recasting is taking a large windfall to pay down your principal balance with the added benefit of recalculating your payment. The additional benefit is you are eliminating the cost of having to refinance the home again. Recasting is the preferred way to pay down your mortgage if you have proceeds from another property you are selling, inheritance, settlement or any type of large windfall. Be sure to speak to your lender ahead of time to make sure the lending institution includes this provision in your mortgage.

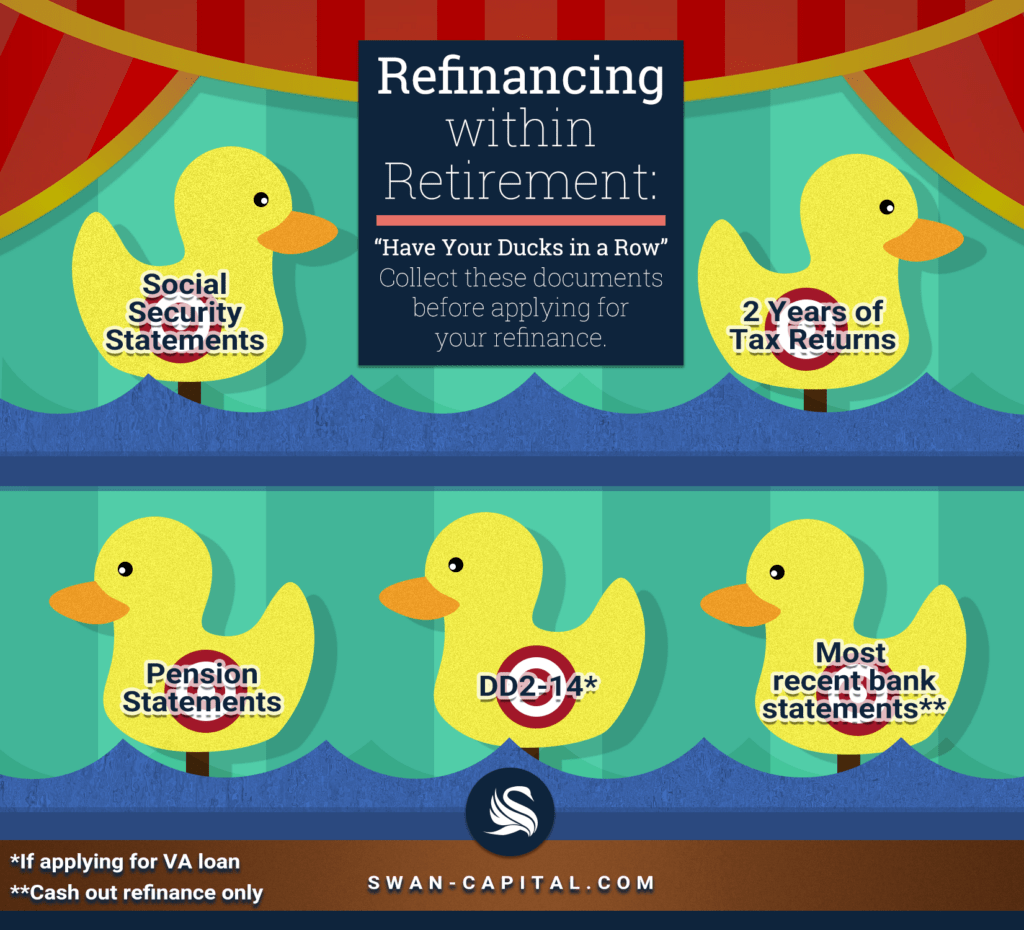

Have Your Ducks in a Row Before Refinancing

These are documents you will want to begin collecting to apply for your refinance:

- 2 Years of Tax Returns

- Social Security Statements

- Pension Statements

- DD2-14 (if applying for a VA Loan)

- (Cash out refinance only) May need to show additional reserve money via supporting documents like a copy of most recent bank statements and investment statements

Remember, as your financial advisor, I am here to help you with any large financial decisions. As a sounding board for your finances, I am happy to discuss strategies to help optimize your retirement plan. Lastly, instead of calling a 1-800 number or filling out a questionnaire online only to regret it later after you are called by every lending professional across the country with a “special low rate”, there is a better way. Call us and we will be happy to connect you with our preferred vendors for refinancing whom we not only recommend but also have worked with personally.

SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC.. Neither the firm nor its agents or representatives may give tax advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. Our firm does not provide and no statement contained in the guide shall constitute tax or legal advice. All individuals are encouraged to seek the guidance of a qualified tax professional regarding their personal situation. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.