Teaching Them to Fish: Saving for the Next Generation

One of the deepest desires parents and grandparents have is to see their children and grandchildren thrive independently. If we’re not careful, we run the risk of raising the next generation to financially know where to go for fish, but never learn how to fish for themselves.

If you’re contemplating setting up investments for your children or grandchildren because you want them to be financially prepared for whatever the world throws at them, where do you start?

At SWAN Capital, we recommend opening a Roth IRA in their name and making regular investments in order to build wealth for them tax free. This way, when it comes time for them to use the funds, their eligible withdrawals are not taxed. We also recommend opening a Roth IRA through an online brokerage firm where the money can be used to purchase stocks, not through a bank or credit union.

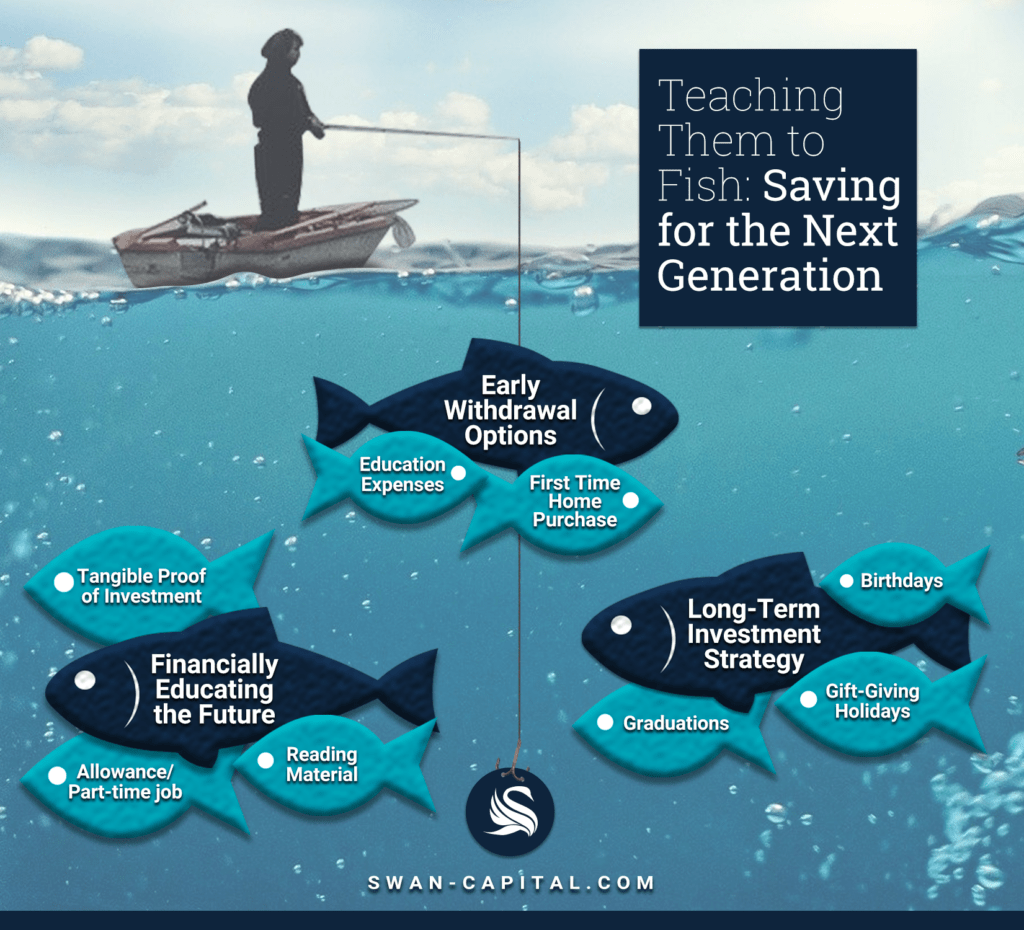

Early Withdrawal Options

But wait, you might say. Won’t my children or grandchildren have to wait until they are 59 ½ to withdraw from a Roth IRA? Not necessarily. Few parents and grandparents realize that you can withdraw from a Roth IRA for qualified education expenses, including tuition, fees, books, supplies, and equipment required for enrollment or attendance—not to mention up to $10,000 for a first-time home purchase!

Now, keep in mind that there are additional stipulations with Roth IRA’s such as earned income requirements, income limits, contribution limits, and withdrawal limitations. We won’t be able to cover all these in one article, but let’s look at earned income requirement, meaning contribution amounts are limited to extent of your earned income amount. If you are a single individual today, you have to earn $12,550 to file a tax return.1 What does the IRS consider earned income? Any income you worked for, including mowing lawns, babysitting, tutoring, and any activity that caused you to earn a wage. The key is to log those earnings in case the IRS ever asks. Lastly, don’t forget to factor in part-time jobs or summer jobs—they all count towards earned income. Withdraws for a Roth IRA are easier because the child is not asking for a tax deduction as they would with a traditional IRA, and they have very little audit risk because they are likely not even filing a tax return.

Long-Term Investment Strategy

Now that you’re interested in opening a Roth IRA, let’s crunch some numbers. If you began investing $100/month for your children or grandchildren for 18 years earning 8% per year, the total would equal $48,000. If they never touched it for college, trade school, or a house down payment, the same $48,000 (without any future contributions invested until they were 59 ½) would be worth $1,100,000 at retirement. If you account for inflation, the $48,000 would be worth $240,000 in today’s dollars.

To maximize the benefit of this investment, every time a major life event happens, consider the following:

- Yearly Christmas Gift Investment $100 investment today = $2,300 at retirement

- Yearly Birthday Gift Investment $100 investment today = $2,300 at retirement

- Yearly Graduation Gift Investment $200 investment today = $4,600 at retirement

If grandparents followed this strategy with each occasion and started this practice when their grandchildren were born, the Roth IRA would be worth $1,313,000 at retirement! The power of compounding interest is that small incremental snow crystals roll up with time to become avalanches.

*This is a hypothetical example provided for illustrative purposes only; it does not represent a real-life scenario and should not be construed as advice designed to meet the particular needs of an individual’s situation.

Financially Educating the Future

You may be thinking, “Andrew, I don’t want to just give my grandchildren and children stocks for Christmas. I might as well give them coal!” Agreed, you should budget for a few tangible gifts, but set aside $50 to $100 for Christmas and birthdays to go into their Roth IRA.

Here are some creative ideas to involve them in their Roth IRA as it is building:

- Give them printed stock certificates. You want investing to become tangible to them, not a pie in the sky idea.

- Print them a copy of the statement. Show them their balances and graphs of their stocks each year.

- Encourage them to put some of their allowance in their Roth IRA account. If they have a part-time job, encourage them to take 20% of their income to put into their account.

- Buy them the Latte Factor by David Bach. Buy them Rich Dad Poor Dad. Remember, children don’t lack the capacity to understand; they lack teachers.

Now, if you want to supercharge your children’s or grandchildren’s future, imagine if you could budget $6,000 per year when your children or grandchildren are 18 till 38 years old (20 years). By retirement age at 59 ½, they would have $1,300,000 at retirement.

I assure you, no one at school is teaching your children and grandchildren to manage their personal finances, and typically, this education is not happening at home, either. On the other hand, the culture is blaring loudly that they should spend everything they make and that unless you have flashy things, you don’t have wealth. I believe it’s our duty in building our legacy to be intentional with what we financially teach the next generation.

I leave you with the words of Haim Ginott, Child Psychologist: “Children are like wet cement. Whatever falls on them makes an impression.”

- Tanza Loudenback, Luis F. Rosa. “How Much Do You Have to Make to File Taxes? Here Are the Benchmarks for the 2022 Tax Year.” Business Insider, Business Insider, 4 Mar. 2022, https://www.businessinsider.com/personal-finance/how-much-do-you-have-to-make-to-file-taxes.

SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.