5 Actions to Take When the Market Drops

As the market takes another unnerving downturn, you call your broker looking for advice and reassurance. After you share your concerns, you hear the empty, infamous words, “Don’t worry—the market will come back.” Very few things raise my blood pressure as much as these 7 words. You think to yourself, “I hope so,” but the sinking feeling returns. “How long will it take? I don’t have forever for it to come back.”

At SWAN Capital, our clients rarely call or email during these downturns for multiple reasons. They each have a written financial plan, their income is planned out for the next 5 to 10 years, and their market-based investments match their personal risk score. They know their family hasn’t been tagged and labeled with a simple conservative, moderate, or aggressive moniker. Lastly, they don’t call or email because they know there are only 5 actions to take during market downturns.

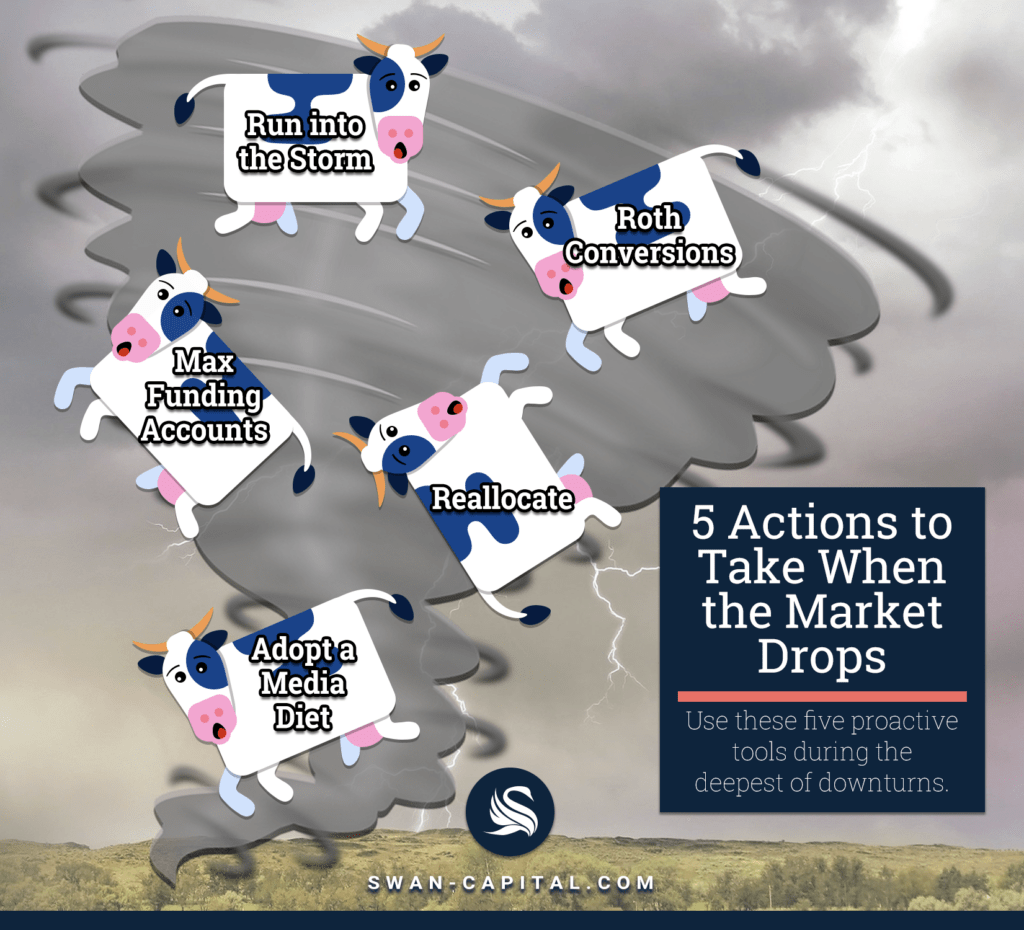

Here are the 5 actions you need to take when the market drops:

1. Run into the Storm

Have you heard the difference between a cow and bison? When a storm approaches, cows run for cover. But they forget they are cows and don’t move very quickly. When the storm arrives, they’re wetter than if they had only stood still. On the other hand, bison have lived on the prairie for a long time. When a storm approaches, they charge into the storm, pelted by rain. But what happens? They come out of the other side that much more quickly. Investing when the market is down? It may feel like running into the storm, but I don’t want you to simply weather or survive a financial storm; I want you to thrive and pivot in the midst of it.

To better prepare yourself for the storm, if you are currently in a traditional 60/40 portfolio of stocks and bonds, consider moving 5% to 10% of your fixed income assets into equities as a cushion in case these circumstances spiral further. You may need this cushion to navigate more volatility that may lie ahead.

2. Roth Conversions

When the market drops it’s a great time to call your CPA to discuss a Roth IRA conversion. Imagine I was holding a large spring in my hands and I compressed the spring to where it removed all of the space between the coils. The slinky represents your account balance that has shrunk due the market volatility. By processing a Roth conversion during the market downturn, you have now positioned your Roth for success. If you move a portion of your depleted account value over to your Roth IRA while the market is down and buy the same positions, you have now primed the spring. Once the market returns and the spring is released, you have the potential for a tax-free recovery.

3. Max Funding Accounts

Many families who are faced with a downturn mistakenly leave their investment accounts only partially funded. When the market succumbs to a downturn, it’s a perfect time to double check your contributions: Have you maxed out your contributions to your 401K or TSP or Sep IR or Simple IRA? Have you maxed out your contributions to your Roth IRA or IRA? Have you maxed out your Health Savings Account (HSA)? Have you contributed to your spouse’s retirement accounts even if your spouse is not working?

4. Reallocate

I’ll share a secret: I love to bake. But I’m my own worst enemy because I find the perfect recipe, but I always need to make a larger or smaller batch than it calls for. I can never get all the tbsps. to match the multiple quantity. The once-perfect recipe ends up too bitter, too salty, or too sweet in the end. Investing is a lot like baking. When a downturn occurs, ask yourself, “When is the last time I reallocated?” A downturn or a run up in the market is a great time to reallocate back to your original portfolio. I’ve preached before that diversification and reallocations are the “free lunches” in finance. By acting on both of these, you can lower your risk and potentially increase your return.

5. Adopt a Media Diet

I have a family friend who armchair quarterbacks. Regardless, if it’s the football game or politics, he screams at the TV so loudly that he believes—and I think it’s possible—that the announcers really do hear him. I’ve tried to remind him that control via watching TV is an illusion. In fact, it’s a fantasy. Watching the financial news is no different. Don’t let fear mongers drive you to the hysteria of constantly checking your account balances. I encourage you to delete your financial apps, lock yourself out of your accounts, or do whatever nuclear option it takes to keep you from looking daily at your account balances.

Use these five proactive tools during the deepest of downturns. When things look bleak, I remind myself of this quote from Joseph Bayly: “Don’t forget in the darkness what you learned in the light.”

This means that you use the good times to create a financial plan with a diversified portfolio, and then when things start to look dim, have great hope! The dawn is ahead.

Please remember that converting an employer plan account to a Roth IRA is a taxable event. Increased taxable income from the Roth IRA conversion may have several consequences including (but not limited to) a need for additional tax withholding or estimated tax payments, the loss of certain tax deductions and credits, and higher taxes on Social Security benefits and higher Medicare premiums. Be sure to consult with a qualified tax advisor before making any decisions regarding your IRA. It is generally preferable that you have funds to pay the taxes due upon conversion from funds outside of your IRA. If you elect to take a distribution from your IRA to pay the conversion taxes, please keep in mind the potential consequences, such as an assessment of product surrender charges or additional IRS penalties for premature distributions. All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified tax professional for guidance before making any purchasing decisions. SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.