My Advisor is Retiring – What do I do?

You just heard the news: your financial advisor is retiring. Maybe at first, you smile because you’re happy to hear your advisor is taking his own advice by retiring. But after the congratulations wear off, you start to think: what about my family? Who will help my family get to and through retirement?

Now, your financial advisor may mention he has a junior associate advisor who will be taking over. Perhaps it is his son, daughter, nephew or someone in the office – but you might be thinking that you really don’t know them that well. You start asking yourself questions, like: Will I receive the same quality of advice? Will the experience be the same, and will this person understand my family’s dreams and desires?

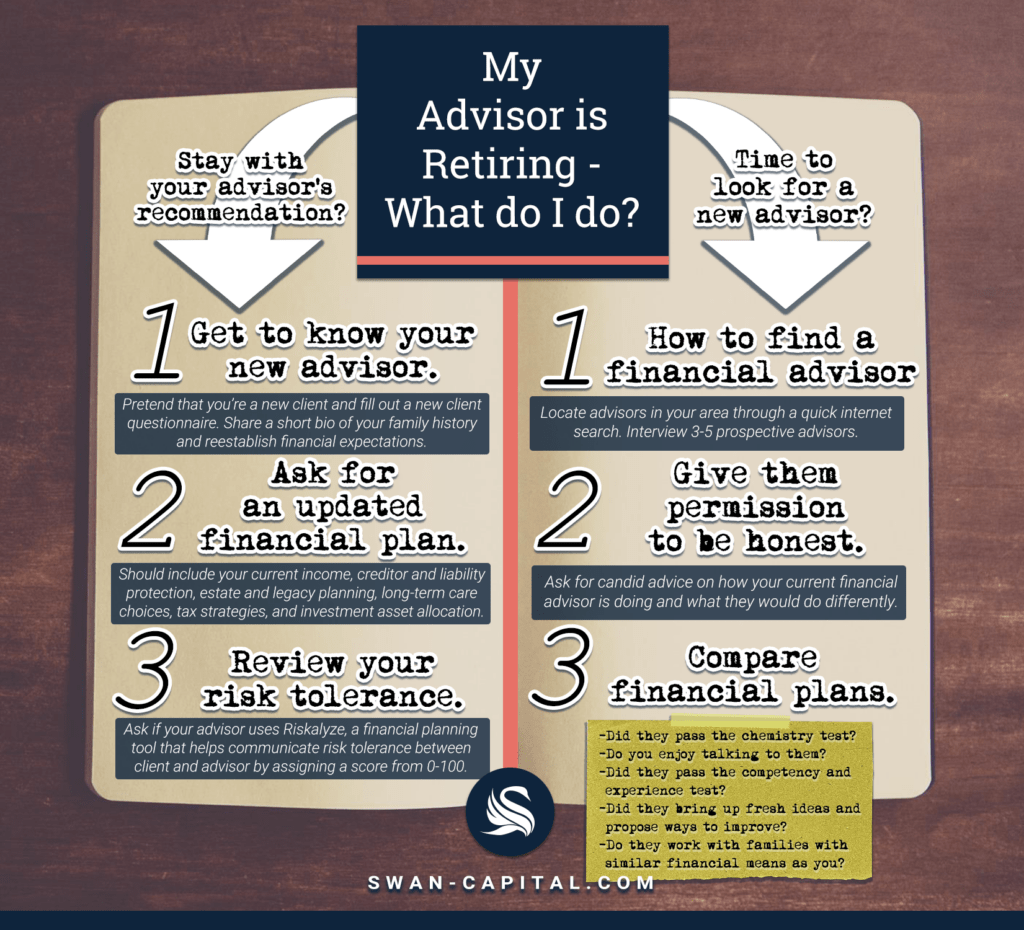

Now, you have a decision on your hand. Do you decide to stay with your current financial advisor’s recommendation? Or, is this a good time to look for a new advisor?

- Get to know your new advisor – When you get to know someone, it’s an exchange –not a one-way street. It is critical that your new financial advisor learns everything he or she needs to know about you. Oftentimes our life and financial situation can change and, over time, a drift of misinformation occurs in a long-term relationship. Therefore, I believe it is a great idea to start from the beginning and fill out a new client questionnaire. Pretend that you are a new client to the firm. The following steps may seem arduous, but they help the new advisor understand your situation better and avoid missing any important details of your financial picture. Even if the advisor believes he understands your situation, I urge you to take it upon yourself to share a short bio of your family history. Start with how you ended up here in town, how you met your spouse, how many children and grandchildren you have and what they are up to, and share how important is to leave a legacy to them. Also, it’s a perfect time to reestablish your financial expectations. What target returns do you want to achieve? What retirement date do you want to stick with? Will you transition to part time work or fully retire for good?

- Ask for an updated financial plan – If you are getting a new financial advisor, even within the same financial firm, I would require an updated financial plan. If you don’t have a financial plan, this is the time to ask for one. As a financial client, you deserve to have a financial plan. An up-to-date plan should detail your current income, protection from creditors and liabilities, estate and legacy planning, long-term care choices, tax strategies and, lastly, an appropriate investment asset allocation.

- Review your risk tolerance – At our firm, we try not to rely on outdated references to terms such as “conservative, moderate and aggressive.” These terms are a good starting point, but they can be too vague. Your new advisor may work with a lot of families that are still in the accumulation phase, but if you are transitioning into retirement, the word “conservative” may not be specific enough. Ask if your advisor uses a tool called Riskalyze. Riskalyze is a third-party financial planning tool that helps communicate risk tolerance between client and advisor, with the goal of pinpointing risk tolerance to a score between 0 and 100.

You may realize while at your advisor’s retirement party that this is the ideal time to look elsewhere for a second opinion. I want to share with you three ways to find a financial advisor and how to interview them accordingly.

- How to find a financial advisor – The easiest way to locate advisors in your area is through a quick internet search. I recommend you interview no fewer than three, and no more than five prospective advisors. We wrote a recent post on how to find a financial advisor that you can read by clicking here.

- Give them permission to be honest – Respectable financial advisors never want to speak ill of their colleagues. Therefore, ask them to give you candid advice on how your current financial advisor is doing and what they would do differently. Remember, it is very important not to take any of their advice personally, and remember that you are the client and that it is not your job to give advice to your advisors.

- Compare financial plans – After meeting with three to five financial advisors, ask yourself the following questions. Did they pass the chemistry test? Do you enjoy talking to them? Did they pass the competency and experience test? Did they bring up fresh ideas and propose ways to improve that you had never heard before? Do they work with people in your same chapter of life? Do they work with families of similar financial means?

Regardless of the loyalty that you feel to your previous advisor, never forget that your family’s money is at stake. You must do what is right for your family, not what’s right for your current financial advisor or your new one. Your responsibility is to your family and if the retiring financial advisor and his new apprentice do not understand, then wish him a happy retirement – and ensure that your retirement is happy too.

SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.