Is the Alphabet Soup Necessary?

When selecting a financial advisor, you can easily go cross-eyed by the alphabet soup of acronyms such as CFA, CLU, ChFC, CFP—and the list goes on. I did a quick search and found a mind-numbing 222 designations! To complicate matters, numerous terms exist for a financial professional such as financial coach, wealth manager, financial advisor, financial planner, investment advisor, and stock broker.

However, credentials alone do not make a financial advisor qualified to help you. Certifications can easily be purchased online, so if you take them at face value and fail to execute your own research and interview process, you might find them as worthless as a celebrity honorary degree.

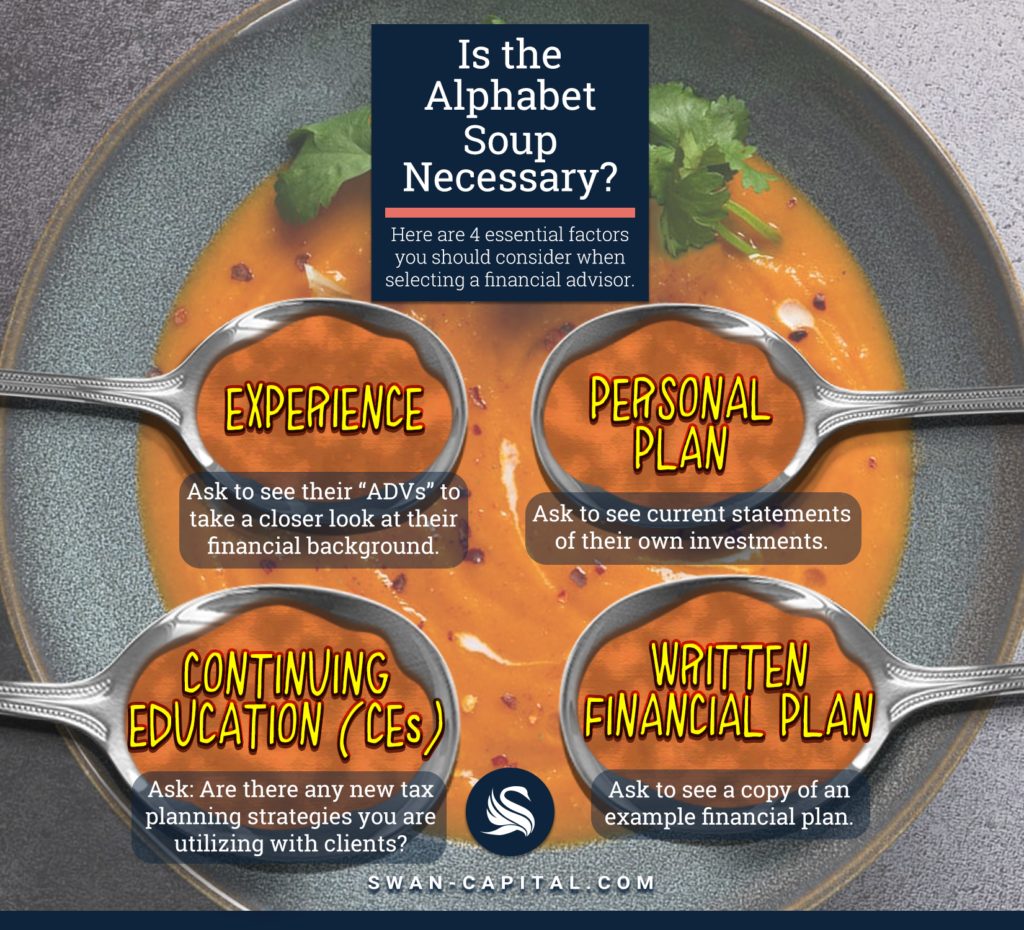

So how do you wade through titles, designations, and backgrounds to determine if a financial advisor is knowledgeable enough to help you? I want to share the 4 essential factors you should consider when selecting a financial advisor.

1. Experience

Those who can’t do, teach; those who can’t teach, remain career students. If you’re just beginning to save for retirement, then it’s acceptable to work with someone new in the field. On the other hand, if you are 5 or 10 years from retirement with a culmination of 30 years of retirement savings on the line, I would be extra careful. You don’t have time to recoup and nurse a new advisor—or your retirement savings—back to health. Let the new guys cut their teeth on someone else’s financial plan. You should demand 10 years of financial advising experience. Ask the following questions: Who do you specialize in working with? Do you work with all ages or certain occupations? What range of net worth do you regularly work with?

ACTION: Ask to see their “ADVs” to take a closer look at their financial background.

2. Personal Plan

Don’t take advice from anyone you wouldn’t trade places with. It may be uncomfortable, but you deserve to know your financial advisor’s finances at a deep level. If you’re going to be 100% transparent about your own finances with them, why can’t they share their own financial position? For example, you can ask: Do you personally invest in the same funds you encourage your clients to invest in? Do you invest in the same investment vehicles? What is your personal net worth? What are your liabilities?

ACTION: Ask to see current statements of their own investments. If their investments differ compared to their recommendations, ask why. Does their reasoning make sense, or do they need to begin to eat their own cooking?

3. Continuing Education (CEs)

A designation can be great, demonstrating that the advisor has pursued continuing education in their field, but not all designations require frequent continuing education. Ask yourself: When is the last time your current financial advisor shared a new tax strategy? When is the last time they brought in your estate planning attorney to coordinate your legal documents with your financial assets? Tax laws, retirement rules, and new investments are being created everywhere. For example, many of the families we work with did not know that Exchange Traded Funds (ETFs) even existed because their previous advisor only exposed them to mutual funds.

ACTION: Ask: Are there any new tax planning strategies you are utilizing with clients?

4. Written Financial Plan

I’ve witnessed many families who worked with a financial planner, but the bizarre reality was that they didn’t have a financial plan. A financial planner doesn’t equate to a written plan. A written down financial plan should consist of a synergistic approach to Asset Protection, Income Planning, Tax Planning, Estate Planning, Long Term Care Planning, and Investment Planning. Don’t settle for retirement plan software. Don’t settle for a 90-page report with templated information that just has your name taped across JOHN DOE. A custom, individualized financial plan will enable you to become more organized and act strategically as market, laws, and economic forces change. A customized financial plan is also critical for easing the burden upon your widow and the beneficiaries you leave behind.

ACTION: Ask to see a copy of an example financial plan—or better yet, ask for a copy of the financial advisor’s financial plan.

In your search for a financial advisor, keep these 4 factors in play as you reach out to potential candidates. I highly advise you not to delegate your research and interview process to another organization or depend on what can be empty credentials. For peace of mind, put your financial future only in the hands of a qualified expert you’ve personally vetted.

SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.