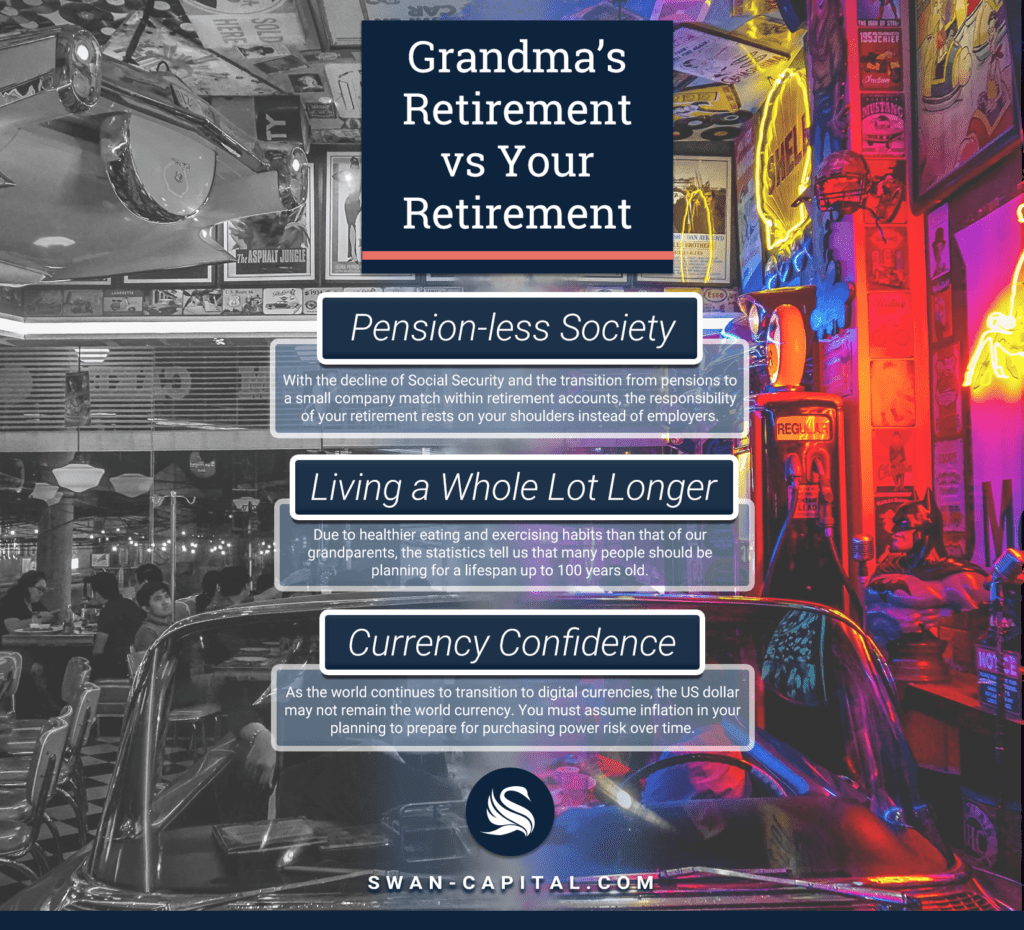

Grandma’s Retirement vs Your Retirement

One of the best years of my life was living with my grandfather. My grandmother had recently passed away so then, as a bachelor after 60 years of marriage, he was lonely. Luckily, I was a bachelor myself right out of college, so I was able to move in with him. One interesting fact is that my grandfather retired from the Navy when he was 50. Imagine – he had to plan for a 43-year retirement! My hope is that your retirement will be 40 years of healthy living, but I encourage you to proactively plan now because your retirement will be different from his.

Three Reasons Your Retirement Will Be Different

Pension-less Society – In the 1980s and 1990s, the stock market continued its historic rise, which many thought would never end. Many employees felt like they were missing out on this prosperous bull run. These employees began to tell their employers that they would like to be in control of their pensions. They were encouraged to take dedicated retirement funds into their own hands by investing it in the stock market. Many companies saw this as an opportunity because then they would no longer have the responsibility of paying out retirement benefits to former employees and their families for the rest of their lives. Over only a few decades, companies transitioned from pensions that would last a lifetime to replacing them with a small company match within retirement accounts like your 401(k). Plus, to make matters worse, it is public knowledge that Social Security is not on solid ground anymore. While people speculate about the future of Social Security, the government will most likely never get rid of it. It will die a slow death of reduced benefits, higher eligibility ages, higher taxes to sustain it, and means testing for high-income earners. As we become a ubiquitous pension-less society, that translates to your retirement being on your shoulders instead of employers.

Living a whole lot longer – What’s wrong with living a long life? Nothing is wrong with a long, healthy, prosperous life besides trying to pay for it. Countless retirees have expressed that they believe they have only a decade longer to live. I laugh because they are their 60s with healthier eating and exercising habits than that of their parents – who lived into their 90s. It is human nature to underestimate how long you think you will live. I believe some people are even superstitious, believing that if they say they will live a long time they will jinx themselves. Long life or not, the statistics tell us that many people should be planning for a lifespan up to 100 years old.

Currency Confidence – History has a of way repeating over time. There was once an empire that was a military powerhouse and global economic superpower. The world operated using this empire’s currency and goods were traded using their denomination. At one time, the sterling pound of the British Empire was the world’s currency. Now, the US Dollar holds this title. However, as the world continues to transition to digital currencies, oil fights for its life as the energy source of the future and our current monetary policy has put our title in jeopardy. The US dollar remaining the world currency for the next 100 years may be wishful thinking. What does that mean for your retirement? It means you must assume inflation in your planning because you will undoubtedly suffer from purchasing power risk over time. Use the Rule of 72: If inflation is 4%, dividing 72 by 4 reveals that you have less than 20 years before nearly everything you buy will double in price. Your investments cannot sit on the sidelines. We cannot accept our money growing at only 1-3%, because it will not keep up with inflation over the long term.

As you can see, Grandma’s retirement will be different from yours. It is time to get back to the old Andy Griffith Show, with principles like living below our means and saving more for our future. We cannot blame anyone for our retirement; we must take steps now to combat these threats to our slice of the American Dream.

All investments are subject to risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. This explanation/chart does not reflect any actual investment, and actual investment values will fluctuate. This illustration is intended to demonstrate mathematical principles and should not be regarded as absolute. Any decline in the market will result in the Rule of 72 becoming less effective as a tool. Information and opinions contained herein that has been obtained from third party sources is believed to be reliable however accuracy and completeness cannot be guaranteed. SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. Advisory services offered through SWAN Capital, LLC.. Neither the firm nor its agents or representatives may give tax advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. Our firm does not provide and no statement contained in the guide shall constitute tax or legal advice. All individuals are encouraged to seek the guidance of a qualified tax professional regarding their personal situation. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.