Financial Milestone: Ages 0 – 40

Retirement can be confusing! How do you know if you’re on track for your age? And what’s the best way to give your children or grandchildren a financial head start so they’re prepared for retirement down the road? One of the best ways to keep yourself and the next generation on track with key financial decisions is to match them up with age-based milestones.

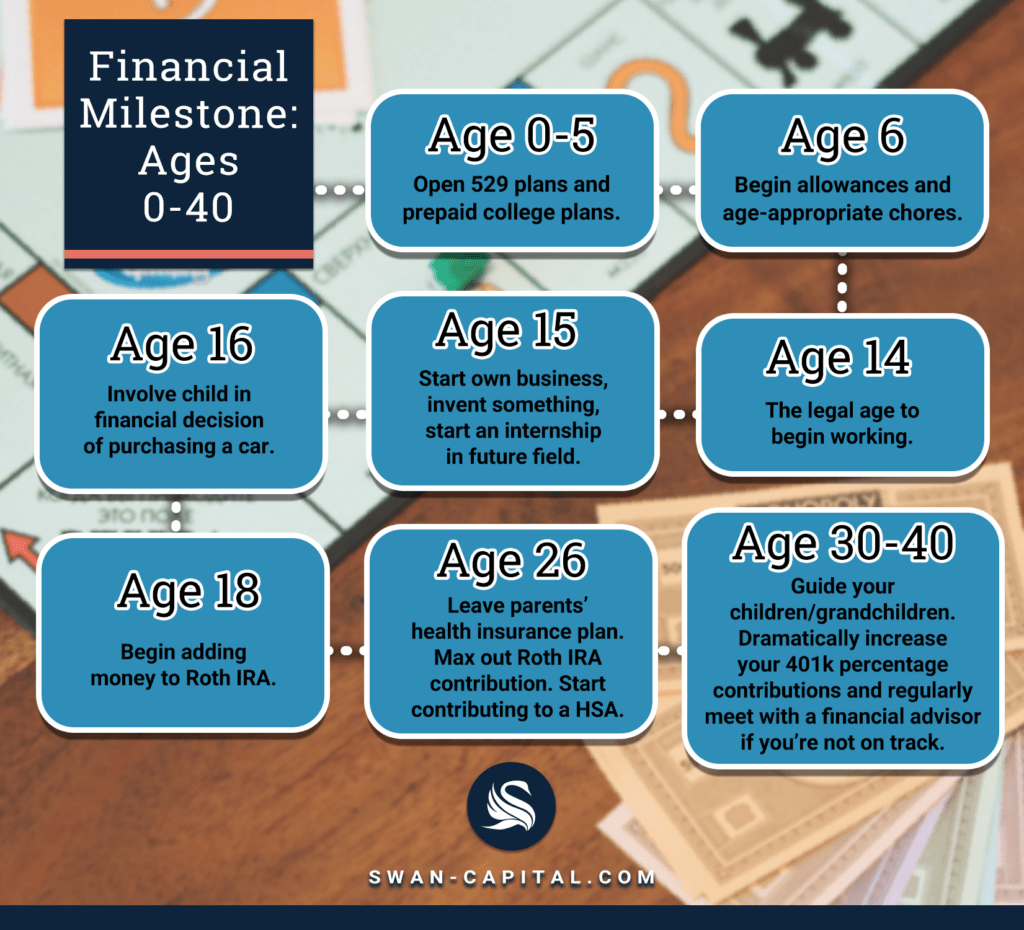

This article breaks down lifetime financial milestones from infancy to adulthood, ages 0 – 40. If you’re no longer in this age bracket, use the following ages as benchmarks to guide your children or grandchildren.

Age 0-5: At this age, it’s a great time to open 529 plans and college prepaid plans for your children or grandchildren. If you want to give your children more options for their education, consider adding money to a brokerage account or opening a Roth IRA for them in lieu of a college prepaid plan. These options will provide them with more flexibility and opportunities, especially if you’re a bigger proponent of trade schools than college.

Another more sophisticated strategy to consider is purchasing a permanent life insurance policy for tax-free accumulation that can be used for college planning, first-time home buying, and eventually retirement for your child. If you’re interested, schedule a one-on-one financial review with a financial advisor to see if this option is best for you.

A child’s first allowance is a great time to teach them not to spend their whole dollar. If a child is raised to spend 100% of their income on themselves, they will do so for the rest of their lives. Instead, buy them a Piggy Bank with three distinct sections: the first, for giving, where they commit 10% of their income to a greater cause such as a charity or church of your choosing; the second section, for saving 20%; and the last section, for the remaining 70% which should be spent on something that excites them. This form of budgeting teaches priceless lessons that will show them that if you work hard, you can play hard.

Age 14: Depending on the state where you live, age 14 is the legal age to begin working. This is a great opportunity for your child or grandchild to learn how to apply for a job, interview, and cultivate a strong work ethic. At age 14, I started at McDonald’s flipping hamburgers. That job was an unforgettable experience because it taught me that I didn’t want to stay at the bottom of the workforce ladder.

Age 15: Encourage your teenage children to step it up a notch. Maybe they should start their own business, invent something, or start an internship in their prospective future field—or even take on a sales job such as waiting tables.

Age 16: One of the most missed financial education opportunities happens when purchasing a car for your child. If you choose to finance the purchase of your child’s car and, for example, the payment is $400 a month, require your teenager to get a part-time job to split the monthly payment. Dave Ramsey calls it the 401K Car Matching Plan. Sit down with your teenager and discuss how to do your due diligence when purchasing a car and determine a healthy monthly payment. If your child is involved from the beginning to help make decisions about the payment and how much they will need to work to help pay for it, they learn the value of hard work.

Age 18: If your child or grandchild has a part-time job, this is a great time for them to begin adding money to their Roth IRA. We’ve mentioned the Roth IRA several times, so let me break it down for you: At SWAN Capital, we recommend opening a Roth IRA in their name through a brokerage firm and making regular investments in order to build wealth for them tax free. This way, when it comes time for them to use the funds, their eligible withdrawals are not taxed.

The benefit of a Roth IRA is that they don’t have to wait until they are 59 ½ to withdraw for qualified education expenses, including tuition, fees, books, supplies, and equipment required for enrollment or attendance—not to mention up to $10,000 for a first-time home purchase! Keep in mind that there are additional stipulations with Roth IRA’s that we don’t have the space to cover here.

Age 26: After age 26, you have to leave your parents’ health insurance plan. At this point, you should be settling into your career and maxing out your Roth IRA contribution each year. If you’re eligible, you should also open and start regularly contributing to a Health Savings Account (HAS). An HAS lets you save pre-tax and withdraw principal and earnings tax-free for qualified medical expenses. The biggest benefit is being triple-taxed advantaged: HSAs offer tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses. Plus, any money you don’t end up using can be saved and invested for future needs such as health care in retirement.

Age 30-40: If you haven’t started saving for retirement at all, you may feel late to the game, but there’s still time. To see if you’re on track, use the millionaire mind formula: age times income equals X divided by 10. The answer equals how much you should have saved for retirement by now. If you’re not where you should be, dramatically increase your 401k percentage contribution and set up regular meetings with a financial advisor to set goals and get yourself back on track.

Use these key lifetime milestones for ages 0 – 40 to guide your children or grandchildren. Each of us has a responsibility to mentor the next generation in financial literacy and even leave a little extra so they can get a head start on life. This is our legacy. As political scientist Kalu Ndukwe Kalu said, “The things you do for yourself are gone when you are gone, but the things you do for others remain as your legacy.”

Be on the lookout for our next article covering ages 50 – 80 to come out next!

SWAN Capital is registered to conduct advisory business in Alabama & Florida and in other jurisdictions as permitted by law. SWAN Capital and its representatives are in compliance with the current filing requirements imposed upon State registered investment advisors by those states in which SWAN Capital maintains clients. SWAN Capital may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Past performance may not be indicative of future results. Therefore, no current or prospective client should assume that future performance of any specific investment, investment strategy or product referred to directly or indirectly in this web site, will be profitable or equal to the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client or prospective client’s investment portfolio. The presence of this website shall in no way be construed or interpreted as a solicitation to sell or offer to sell advisory services to any residents of any State the firm is registered in or where otherwise legally permitted. All written content is for informational purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. Advisory services offered through SWAN Capital, LLC. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Although there is no up-front tax deduction for Roth IRA contributions, qualified distributions are income tax free. Investing involves risk, including the potential loss of principal. SWAN Capital is not affiliated with the U.S. government or any governmental agency.

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.