Growing up, the food pyramid gave me a visual picture to understand that it wasn’t so wise to eat 100% junk food. I understood by the simple graphic that moderation was the key to living in balance. Financial gurus will tell you to save everything you can and live on a shoestring budget now so you can live like a king someday in the future. I don’t believe in that and it is not biblical, either. Living in balance and enjoying every season is essential to a happy life. Other financial pundits will tell you that you need to budget and watch every penny you spend. When I hear that, it reminds me of the media’s weekly hot new diet. It may sound great. but it is simply not sustainable for most people. Your willpower will not be able to stick it out for the long term.

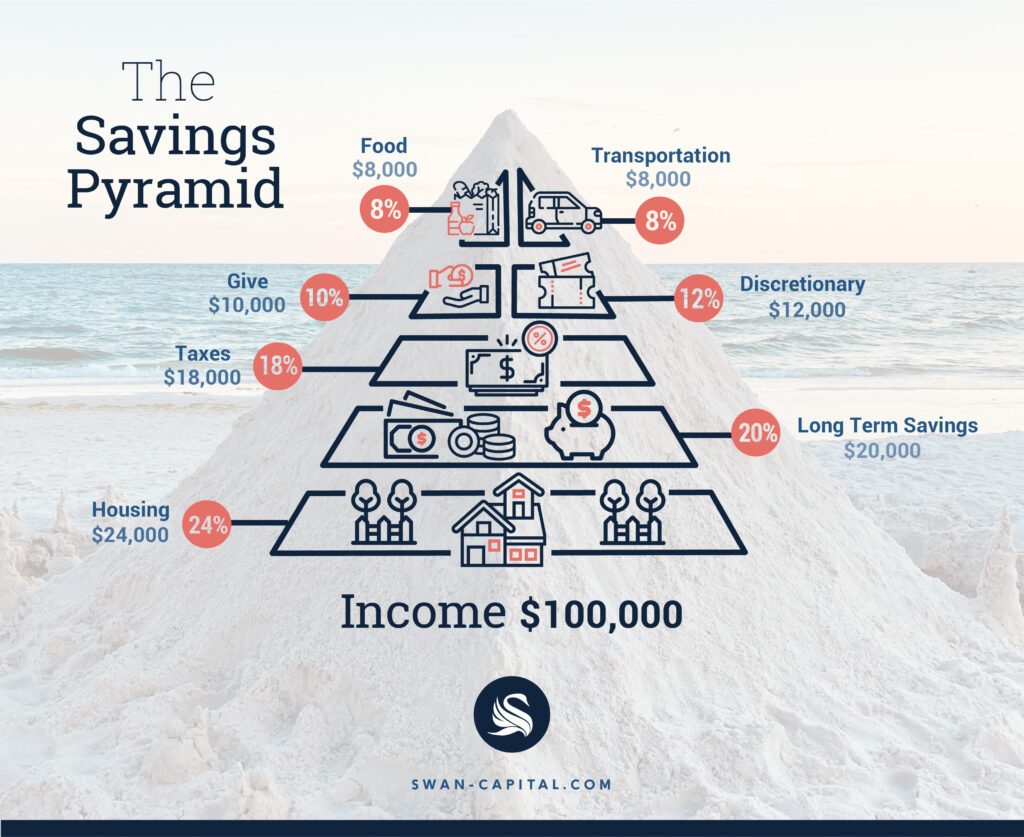

Instead, consider what a healthy savings pyramid looks like. I believe you don’t necessarily have to budget, if you prioritize the right things. What those things are will be unique to you – but here is my version of the Savings Pyramid.

10% – Giving – The first thing I prioritize is giving. My personal belief is that depression and suicide are on the rise not because people are living in tough economic times. History has proven that despite advancements in standard of living, people are still unhappy. I believe people are depressed because they are living for themselves. We were not created to be big enough nor an important enough cause to live strictly for ourselves. Instead, through investing your life and yourself into your community, charitable organizations and faith, you can find purpose. Now that is something to live for.

20% – Long Term Saving – This is what we call the investment trap door. Investing long term does not mean delayed spending. It means saving for your retirement via a Roth IRA and/or 401(k) or other retirement savings vehicles. I believe that you should save 20% of your income if possible to help you and your family can maximize retirement accounts and receive the highest match on your 401(k), where available. Remember, you need to have a healthy emergency savings fund before long term investing above your 401(k) match.

18% – Taxes – Now this number is obviously unique to everyone, but in my experience, it is a figure that many can attain through proper planning. The government is a great inventor of ways to tax its citizens. We must be willing and able to pay those taxes, including property taxes, income taxes and state taxes. We need to ensure we have allocated enough of our earnings to pay all of those various taxes. We should strive to be a happy taxpayer one that is concerned enough to participate. What do many people do? I see many complain they don’t get involved. If you’re unhappy about taxes and where it is going get involved.

24% – Housing/Utilities – Be careful about the house you choose. Be even more careful if you are helping your children buy a home or thinking about helping them with a down payment. Also, one key mistake I see many families make is deciding to move into a too-expensive neighborhood. That’s because, in my experience, certain neighborhoods have expectations. They expect you to drive a certain car, ride a fancy lawnmower, have your kids dressed appropriately and attend certain schools. We call it magnetic spending, because some people buy nice things to avoid having friends and neighbors judge you for not living up to their preconceived picture of you.

8% – Food – My eyes have enlarged at seeing families’ grocery and dining out bills. America is eating its future away. Food is essential, but I have heard every excuse in the book. Families have told me that they eat healthily. I politely keep it to myself that my family eats nearly no white starches, heavy fruit/vegetable ratio with lean high-quality meats. The cost for most families is not that healthy foods cost more, it is that most families buy convenience.

8% – Transportation – If you have that nice house we already talked about, you may have also gone overboard spending too much time and money focused on how to get from point A to point B. You don’t want to neglect your retirement savings because you have luxury cars as depreciating assets. If someone looks down on you for what you drive, you may need new passengers in your life.

12% – Discretionary – Entertainment, Education, Clothing – We need to explain what discretionary is. The only four things I believe are basic financial human rights that we all should have are shelter, water, food and electricity. Always keep in perspective that everything else is optional. Netflix, cell phones and even the internet in 2020, are not basic human rights. The local library has free internet if you need it. I believe that families that follow this savings pyramid or one similar to it can live a more financially balanced life. If you don’t live in moderation, it comes at a cost – and that cost might be your financial future. Furthermore, as a parent and grandparent, it is important not only to teach the savings pyramid, but to model it for your loved ones. They often watch your actions rather than listen to your words

The views expressed above reflect the views of the author as of the date referenced. These views may change as market or other conditions change. This report is not intended and should not be used to provide financial advice and does not address or account for an individual’s circumstances. We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC (AEWM) and/or Swan Capital. AEWM and Swan Capital are not affiliated companies. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions.645349-06/20

Thought this info was useful?

Please share it on your social media platforms!

Ready to Take the Next Step?

For more information about any of our products and services, schedule a meeting today or register to attend a seminar.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.

Download this 8-page guide was created for you to better understand how taxes could affect your retirement income.